Wealth Transfer

An estimated $90 trillion is being transferred as baby boomers pass on assets to their children.

Debt Transfer

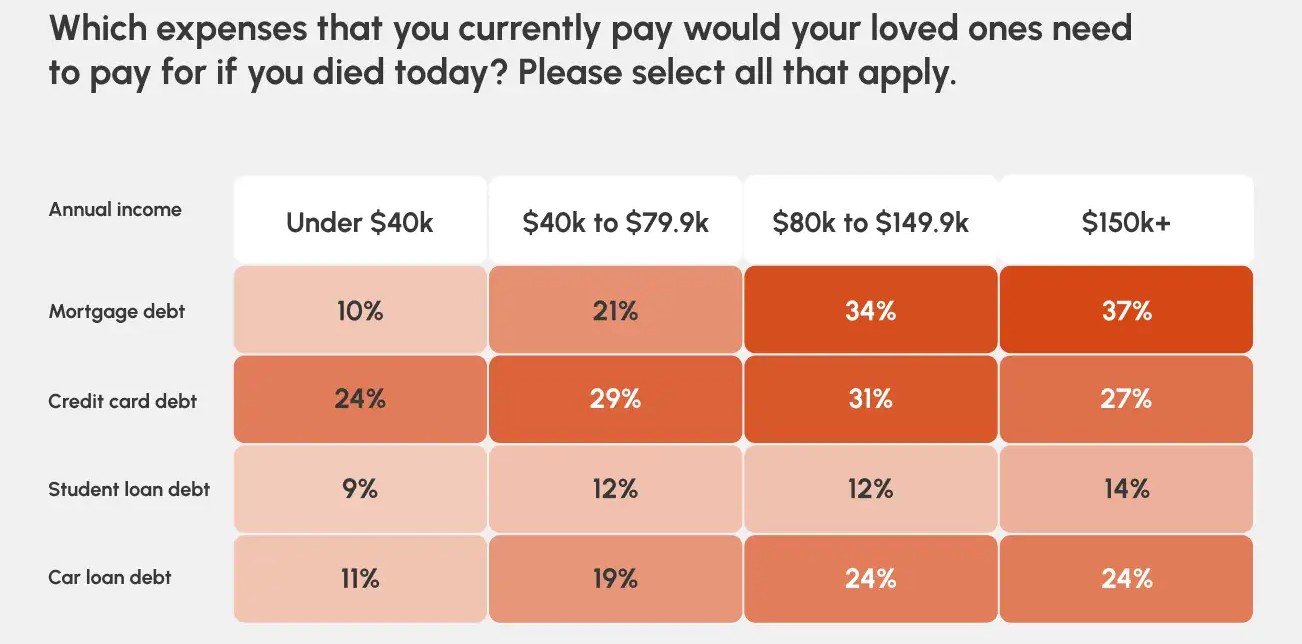

Simultaneously, a significant amount of debt is also being transferred. A survey by Policygenius reveals that:

- 46% of Americans expect to leave debt behind when they die.

- 58% of those earning over $150,000 per year anticipate their loved ones inheriting their debts.

- 21% of those expecting to leave debt do not have life insurance to cover it.

Debt Burden

On average, American households carry:

- $10,000 in credit card debt

- $241,000 in mortgage debt

- $59,000 in student loan debt

- $22,000 in car loans

Generational Differences

- 43% of baby boomers say their loved ones would need to pay off debts if they passed away now.

- 52% of millennials expect the same.

- 60% of Americans living with their children anticipate their loved ones would need to pay their debts if they died today.

Survey Methodology

Policygenius commissioned YouGov to conduct the survey, polling 4,063 Americans aged 18 or older with a margin of error of +/- 2%.