What are Price Oracles?

Price oracles are like messengers that bring information from the outside world into the blockchain. They provide accurate and reliable data, especially pricing information, to smart contracts running on blockchains.

Why are Price Oracles Important in DeFi?

Price oracles are essential for DeFi because they:

- Determine collateralization levels in lending protocols

- Maintain the peg of stablecoins to external assets

- Track prices of real-world assets in synthetic asset platforms

Types of Price Oracles

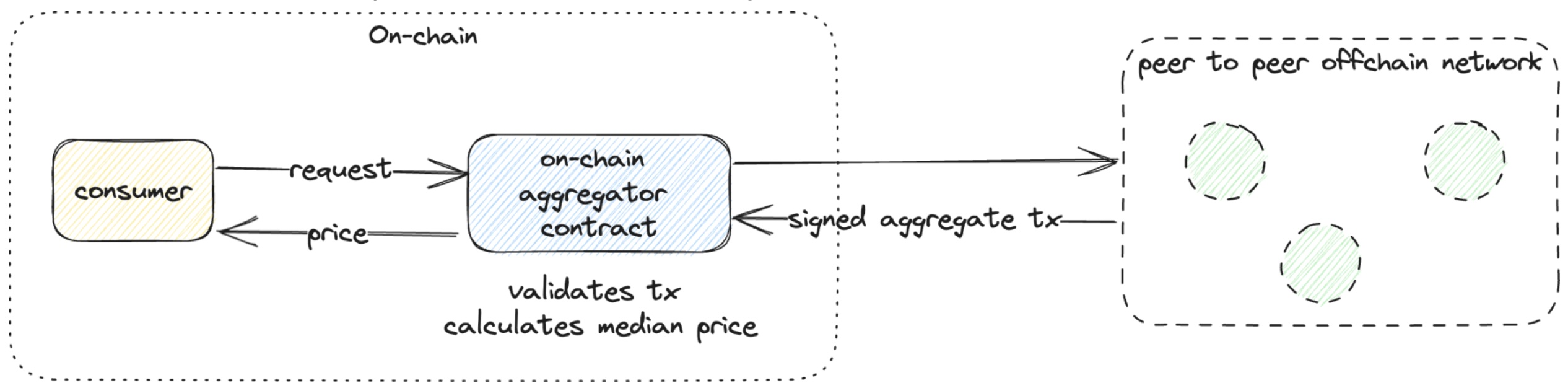

Chainlink

- Network of oracles that gather data and feed it to the blockchain

- Decentralized and cost-effective

Pyth

- Similar to Chainlink, but operates across multiple chains

- Uses a Solana-powered blockchain to aggregate data

TWAP

- Calculates the average price of an asset over a specific time period

- Resistant to price manipulation, but can be complex to implement

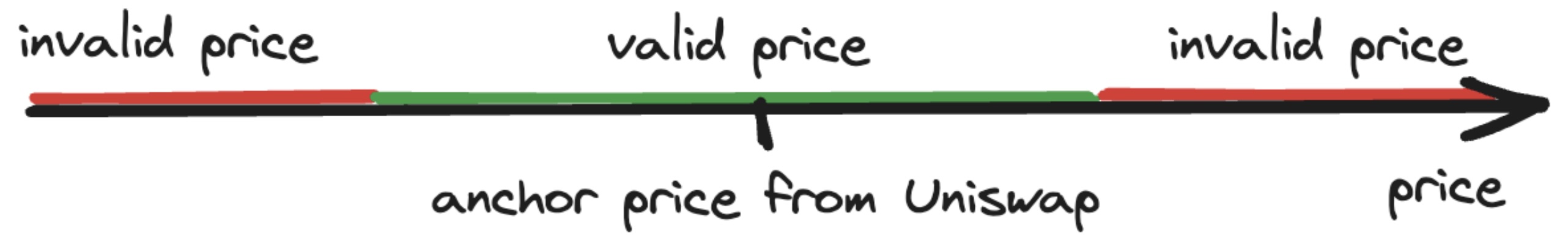

Open Price Feed

- Combines prices from multiple sources, including Chainlink and Uniswap

- Protects against incorrect data from external sources

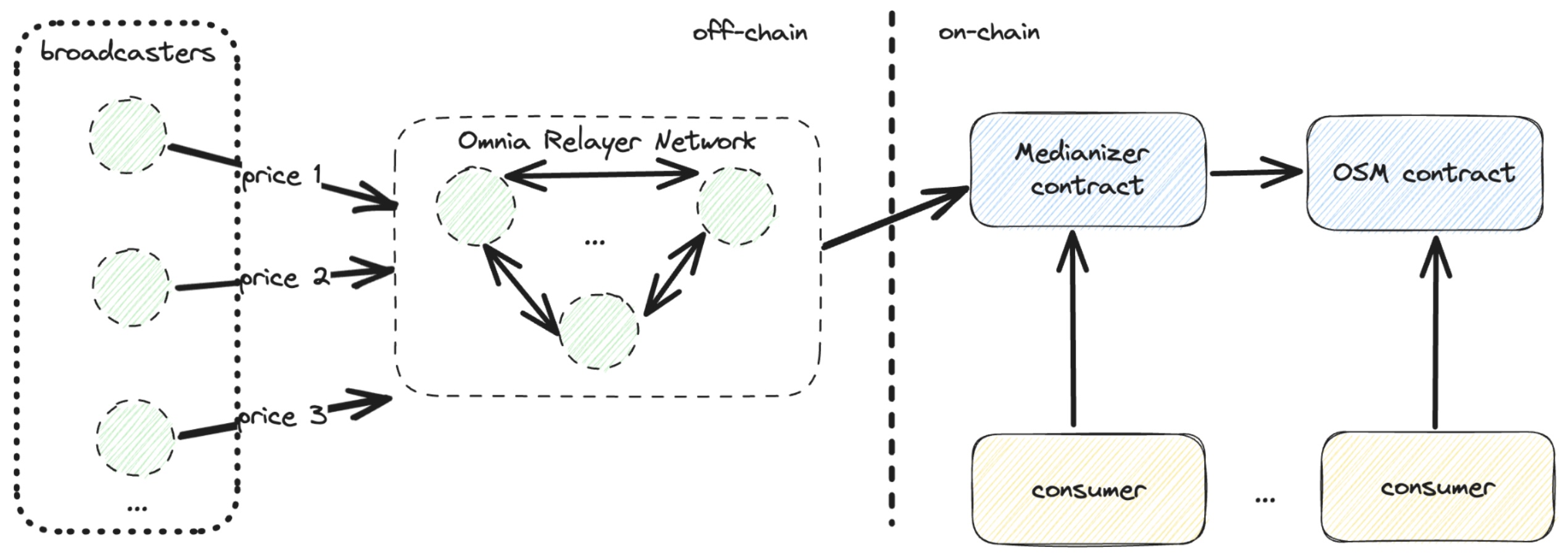

Maker DAO

- One of the oldest oracles in DeFi

- Uses an off-chain network to gather price data

Conclusion

Price oracles are crucial for the security and functionality of DeFi projects. While there is no one-size-fits-all solution, understanding the different types of oracles and their advantages and disadvantages is essential for choosing the best option for your project.