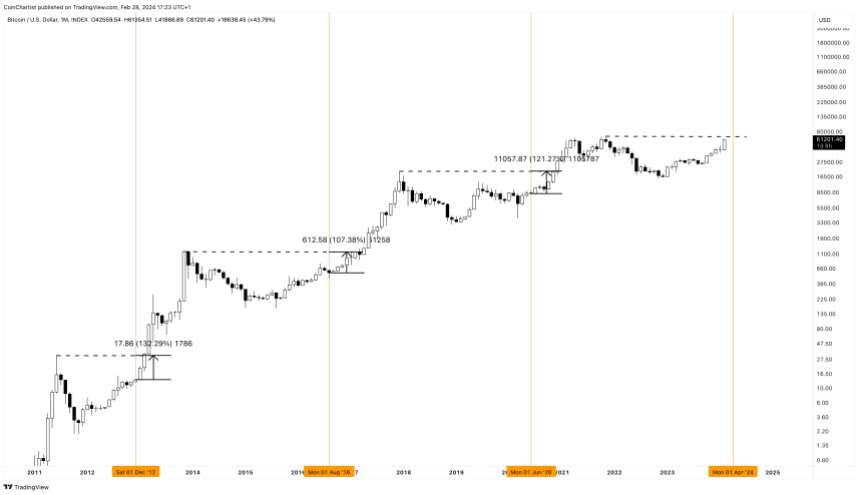

Bitcoin is hovering around $60,000, close to breaking its all-time high. This would be a significant milestone, as Bitcoin typically sets new records only after its halving events.

The Halving’s Impact

The halving reduces the number of new Bitcoins entering circulation, making the supply more scarce. This can lead to higher prices, especially when demand remains steady or increases.

Unprecedented Price Action

Unlike previous market cycles, Bitcoin is currently near its all-time high before the halving. In the past, it took months after the halving for new highs to be reached.

Changing Dynamics

Several factors are contributing to this change:

- Increased liquidity: China is injecting liquidity into the global economy, boosting demand.

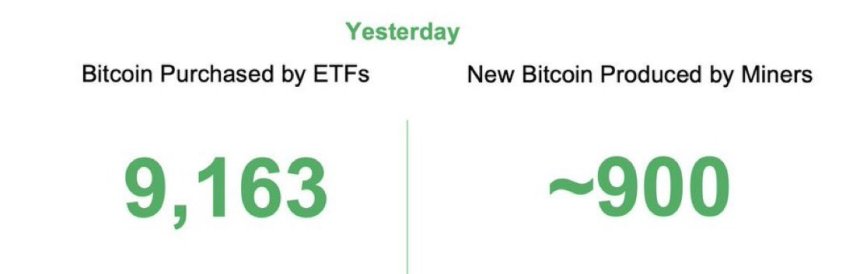

- Spot BTC ETFs:

These ETFs are purchasing large amounts of Bitcoin, outpacing the new supply.

These ETFs are purchasing large amounts of Bitcoin, outpacing the new supply.

Institutions Front-Running the Halving?

ETFs are absorbing ten times the new supply of Bitcoin daily. When the halving occurs, the block reward will be halved, further reducing supply. This suggests that demand is outpacing supply, which could lead to higher prices.

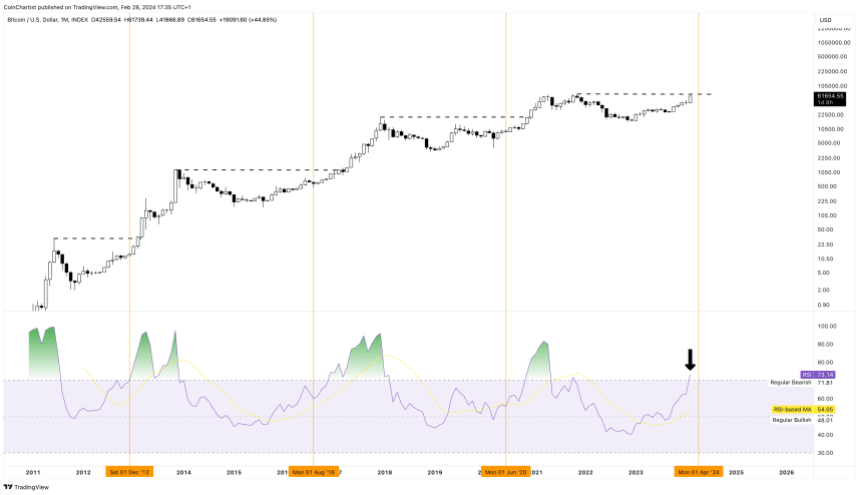

Strength in the Market

Bitcoin’s Relative Strength Index (RSI) is above 70, indicating overbought conditions. However, historically, Bitcoin has remained overbought for extended periods during bull runs.

Conclusion

The combination of strong demand, dropping supply, and overbought conditions suggests that Bitcoin may continue to rise in the coming months. While it’s uncertain whether it will reach a new high before the halving, the market conditions are favorable for further gains.