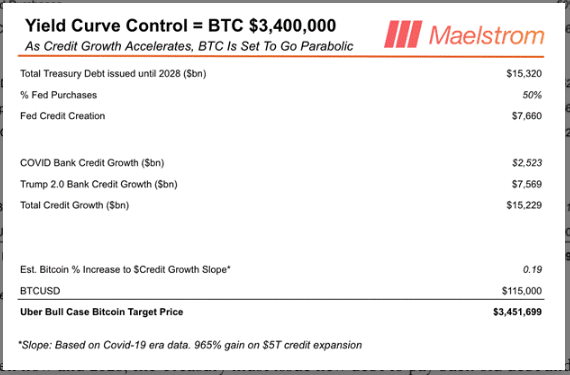

Arthur Hayes, a former crypto exec, is making some bold predictions about Bitcoin’s future price. He believes it could skyrocket to a staggering $3.4 million by 2028. But this prediction rests on some pretty big assumptions.

How Hayes Arrived at $3.4 Million

Hayes’s forecast hinges on a massive increase in credit growth – around $15.3 trillion – from the Federal Reserve and commercial banks by 2028. A key part of his theory involves the Fed buying half of the new Treasury debt, with bank credit growing by another $7.57 trillion.

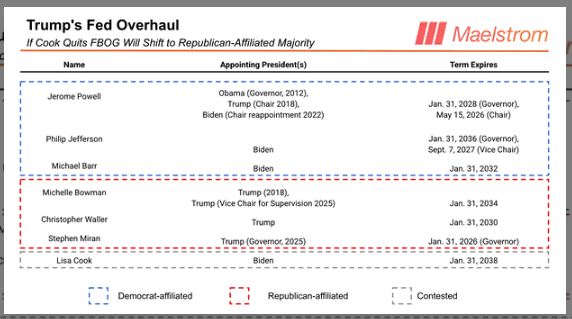

The Fed: A Key Player

Hayes believes that who controls the Federal Reserve is crucial. He claims that a specific political team plans to significantly reshape Fed policy through appointments and regulatory pressure. This would involve gaining control of four seats on the Board of Governors to influence short-term interest rates. He names specific Fed governors and outlines a potential strategy to achieve this.

Stablecoins and Global Capital Flows

Hayes also factors in the movement of money from Eurodollars and foreign deposits. He estimates that $10-13 trillion could shift away from offshore dollar deposits, driven by concerns about US support during financial crises. This, combined with other overseas holdings, creates a massive $34 trillion pool of potential investment.

He predicts that stablecoin companies, especially those holding reserves in US bank deposits and Treasury bills, would attract a significant portion of this money. He even suggests that social media platforms could become major players, drawing in trillions from retail deposits in developing countries.

Increased Demand for Treasuries

This influx of money into stablecoins, which often hold US Treasuries, would dramatically increase the demand for short-term US debt. This increased demand could allow the Treasury to offer lower yields and still find buyers, giving the US government more control over global interest rates.

In short, Hayes’s prediction is a complex interplay of credit growth, political maneuvering within the Federal Reserve, and a massive shift in global capital towards stablecoins. Whether his assumptions hold true remains to be seen.