Bitcoin and the broader crypto market took a major hit, causing a massive wave of liquidations. Let’s break down what happened.

Bitcoin’s Tumble

Bitcoin’s price, after briefly flirting with $118,000, took a nosedive, falling below $113,000. This wiped out recent gains and sent shockwaves through the market. The drop accelerated quickly, starting the week with a sharp plummet.

The Ripple Effect: Altcoins Suffer Too

It wasn’t just Bitcoin feeling the pain. Ethereum and other altcoins also plummeted, with many experiencing even bigger losses than Bitcoin. Dogecoin and Chainlink were particularly hard hit, dropping 10.5% and 9% respectively.

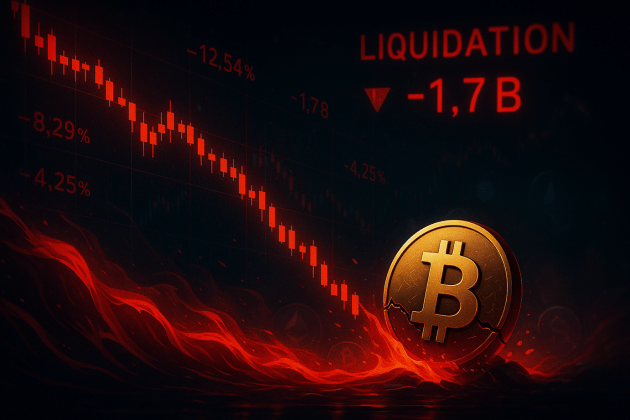

Massive Liquidations: $1.7 Billion Wiped Out

The volatility led to a huge wave of liquidations in the crypto derivatives market. Liquidation means traders’ positions were automatically closed because they lost too much money. A staggering $1.7 billion was wiped out in a single day!

The vast majority (around 95%) of these liquidations were from traders who were betting on the price going up (long positions). Only a small percentage (about 5%) were from those betting on a price drop (short positions).

Top Losers:

- Ethereum (ETH): $496 million in liquidations. Surprisingly, this was higher than Bitcoin’s.

- Bitcoin (BTC): $285 million in liquidations.

- Solana (SOL):

$95 million in liquidations.

$95 million in liquidations. - XRP:

$78 million in liquidations.

$78 million in liquidations. - Dogecoin (DOGE): $61 million in liquidations.

A Rare Event, But Not Unprecedented

While crypto market volatility and liquidations are common, the scale of this event was exceptional. The easy access to leverage in crypto trading often contributes to these dramatic swings.