Despite Bitcoin’s recent price bump, many big traders are still betting against it. This is according to data from on-chain analytics firm Glassnode.

Bearish Bets Still Dominate

Glassnode looked at the “Long/Short Bias” – basically, how many traders are betting on Bitcoin going up (long) versus going down (short). A positive number means more people are bullish, while a negative number means more are bearish. Right now, the number is negative, meaning short positions (bets against Bitcoin) outweigh long positions by a significant margin – about 485 BTC, or roughly $56.2 million. This has been the case for a while, even with the recent price increase. Historically, crypto often moves against what most people expect, so this bearish sentiment might actually be a good sign for Bitcoin’s price.

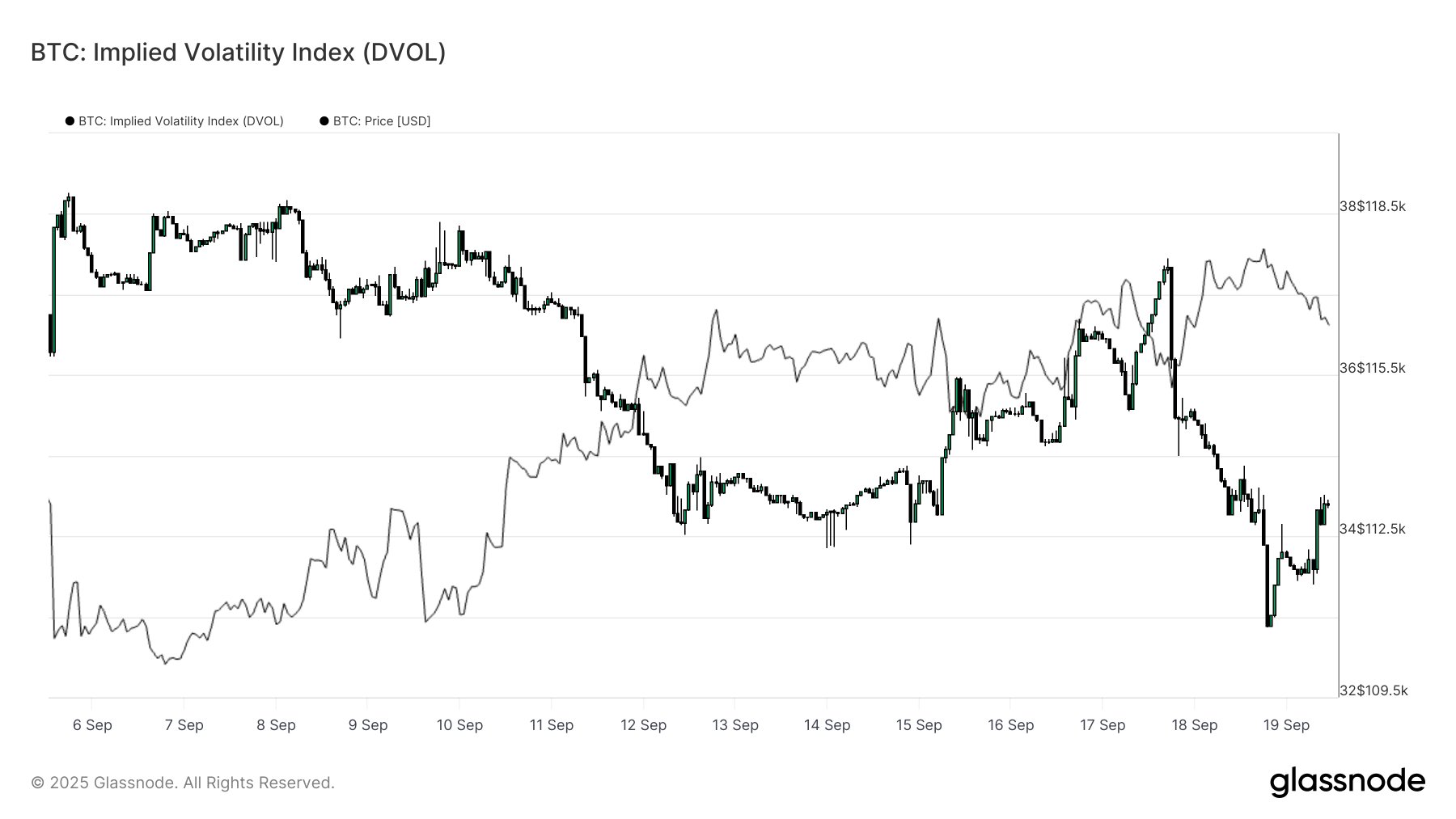

What the Options Market Says

Glassnode also checked out the Bitcoin options market. They looked at two key indicators:

-

Implied Volatility (IV): This shows what traders expect Bitcoin’s price to do in the future. The “At-The-Money” (ATM) IV focuses on options with strike prices near the current Bitcoin price. The 1-week ATM IV spiked before a recent Federal Reserve meeting but dropped afterward, suggesting less expected volatility in the short term. Longer-term options didn’t react much to the Fed’s announcement.

-

IV Index (DVOL): This is a broader measure of options market volatility, combining IV across different strike prices and timeframes. After the Fed meeting, DVOL also fell, indicating the market isn’t expecting any big price swings soon.

Bitcoin Price: A Slight Dip

Bitcoin briefly climbed back towards $117,900 but has since pulled back to around $116,000.