Ethereum (ETH) has been on a bit of a rollercoaster lately. After failing to break the $5,000 mark in August 2025, many are wondering if it’s finally hitting bottom. A recent analysis suggests we might be close.

Binance Open Interest: A Key Indicator

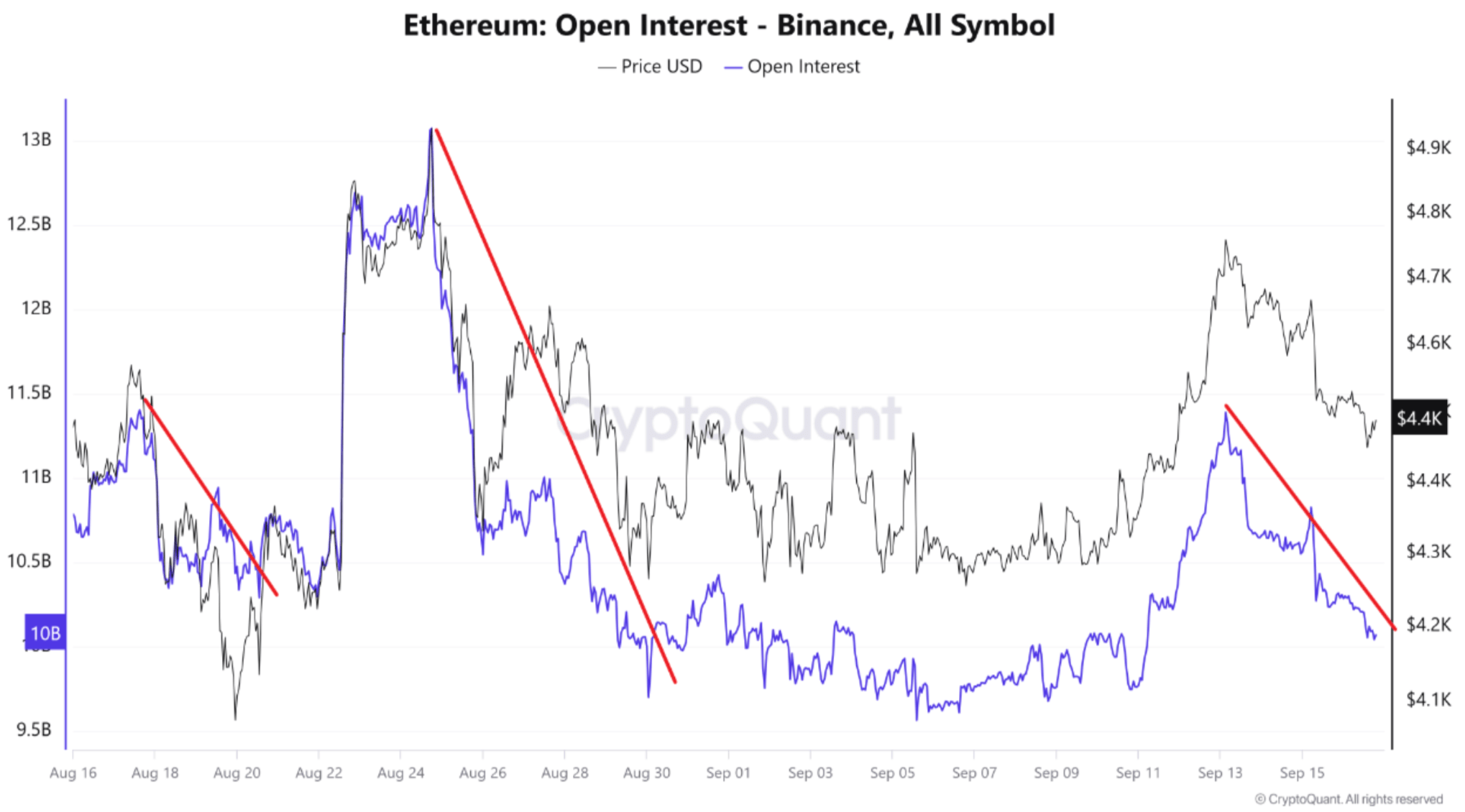

One analyst looked at the Binance open interest (OI) for Ethereum. Open interest basically shows how many outstanding futures contracts there are. This is a good indicator of market sentiment. The analyst noticed a pattern:

- Past Trends: Over the last three months, drops in Binance ETH OI have consistently preceded price corrections. These OI drops averaged around 14.9%, while the actual ETH price usually dipped about 10.7%.

- Recent Drops: Several significant drops in Binance ETH OI occurred in August and September 2025. For example, one drop saw a 25% decrease in OI.

- Current Prediction: The analyst predicts the OI might fall to around $9.69 billion, suggesting ETH is near its local bottom. However, a further price drop before the bottom is reached is still possible.

Institutional Support and Price Predictions

Another analyst pointed out that the Fund Market Premium (FMP) – which measures the price difference between futures and spot markets – has been mostly positive since July 2025. This suggests strong institutional buying, which helped push ETH from $2,500 to $4,400 during that time. This analyst believes ETH could hit $6,800.

Adding to the positive outlook, ETH exchange reserves are shrinking fast. Another analyst even predicted ETH could reach $5,500 in September.

The Current Situation

Despite the positive signs, ETH’s recent price action has been somewhat flat. At the time of writing, ETH is trading around $4,491. While the overall outlook is bullish, it’s worth remembering that the market can be unpredictable.