A massive amount of Ethereum (ETH) was recently purchased by a major Bitcoin whale, causing quite a stir in the crypto market. Let’s break down what happened and what it might mean.

A Whale’s Big Buy

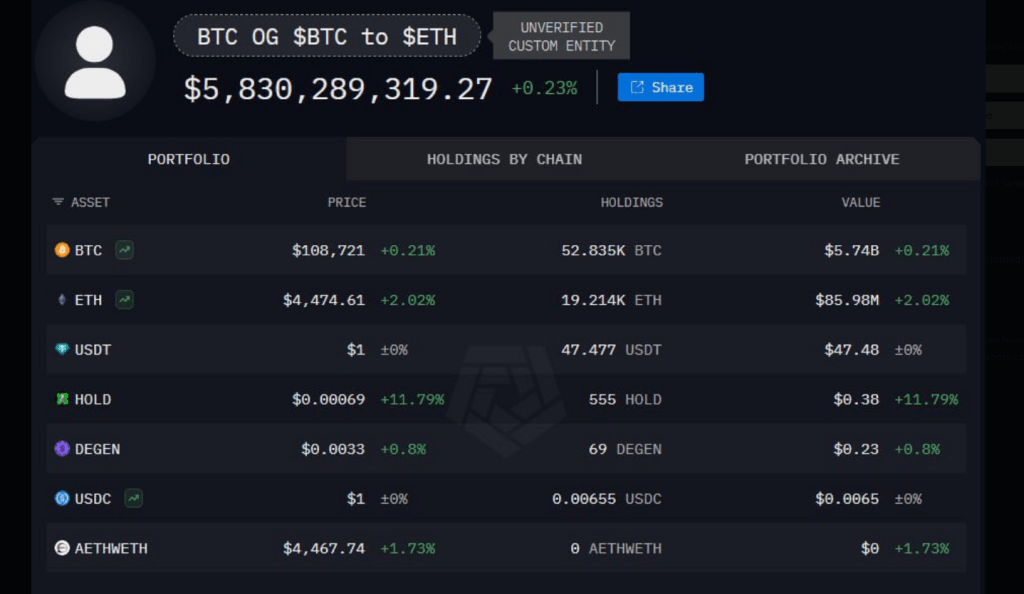

One of the biggest players in the Bitcoin world secretly bought a whopping 820,220 ETH over two weeks—that’s roughly $3.6 billion worth! This huge purchase has everyone talking, especially because it shows a significant shift of investment from Bitcoin to Ethereum. This kind of concentrated buying usually boosts confidence and encourages other big investors to jump in.

Ethereum’s Current State

Following the whale’s purchase, Ethereum’s price is doing well. At the time of writing, ETH is trading around $4,390, with a market cap close to $538 billion. While the price is up 2% in the last 24 hours, the overall derivatives market shows a more mixed picture. Trading volume is down, suggesting some consolidation in the market.

Price Predictions and Market Sentiment

Experts predict Ethereum could climb another 11% to hit $4,870 by October 1st. While the overall sentiment is bullish, the Fear & Greed Index is at 46 (leaning towards fear), indicating some uncertainty. Past performance shows a lot of price fluctuation.

Potential Dip on the Horizon?

Despite the positive outlook, some analysts, like Ted, are warning of a potential dip. They believe Ethereum might briefly retest the $4,000 support level before continuing its upward trend. This is based on typical market patterns and the presence of large amounts of sell orders waiting to be filled. Ted clarifies that this is a short-term bearish prediction.

What to Watch For

Market watchers are keeping a close eye on three key things:

- More Whale Activity:

Will other large investors follow suit?

Will other large investors follow suit? - Derivatives Open Interest: Will it continue to climb, showing sustained investor confidence?

- Price Support:

Can Ethereum hold above the crucial $4,000 level?

The recent whale activity suggests growing institutional interest in Ethereum. However, the decrease in derivatives trading volume shows some investors are taking a cautious approach. The coming weeks will be crucial in determining the direction of Ethereum’s price.