Ethereum is currently holding its own amidst a bearish crypto market, defying the downward trend affecting most other altcoins. Let’s dive into the details.

Ethereum’s Unexpected Strength

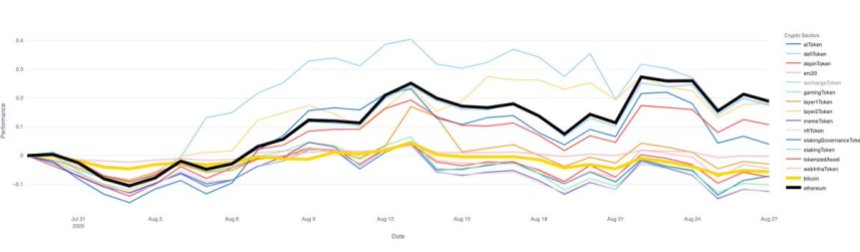

Despite recent selling pressure and a general market downturn, Ethereum (ETH) is showing remarkable resilience. While Bitcoin and other cryptocurrencies are struggling, ETH is bucking the trend, maintaining its position as a top performer. Data shows that no other altcoin sector has outperformed Ethereum over the past month, with only DeFi and Layer 2 projects coming close. This suggests that Ethereum’s dominance is growing, even during market uncertainty.

Capital Rotation Towards Ethereum

This performance indicates a significant shift in the market. Capital is flowing away from Bitcoin and into Ethereum, a phenomenon many analysts are calling “Ethereum season.” This is a classic pattern in crypto markets: Bitcoin leads the initial rally, then the momentum shifts to Ethereum, and finally to smaller altcoins. Currently, Ethereum is attracting institutional and whale investors, suggesting strong confidence in its future growth potential. The growing adoption of Ethereum in DeFi, NFTs, and enterprise solutions further supports this bullish sentiment.

While some analysts believe this cycle will be longer due to factors like spot ETFs and increased global adoption, others remain cautious about the overall market weakness. Regardless of differing opinions, Ethereum’s performance is undeniable, highlighting its increasing importance in the crypto landscape.

ETH’s Recent Price Action and Future Outlook

Ethereum is currently trading around $4,366 after a recent pullback of almost 9%. This follows a significant rally from lows below $2,000 earlier this year. Despite this correction, the long-term outlook remains positive. Key moving averages are trending upward, providing strong support levels. The crucial $4,200-$4,300 range is currently being tested; holding this zone would signal further consolidation before another push towards $4,800. However, a breakdown could lead to a drop towards $3,800.