MicroStrategy, led by Michael Saylor, just made another massive Bitcoin purchase – 3,018 BTC to be exact! This adds to their already impressive Bitcoin holdings.

A $357 Million Bet on Bitcoin

This latest purchase cost them around $357 million, averaging about $115,829 per Bitcoin. Interestingly, this buy happened while Bitcoin’s price was dipping, showing they’re not afraid of a little market downturn. In fact, this purchase was much bigger than their previous two weekly buys combined!

MicroStrategy’s Bitcoin Empire Grows

After this acquisition, MicroStrategy now owns a staggering 632,457 BTC. That’s worth almost $71.1 billion at current prices – a huge profit compared to their original cost basis.

More Than Just Bitcoin: MicroStrategy’s Success Story

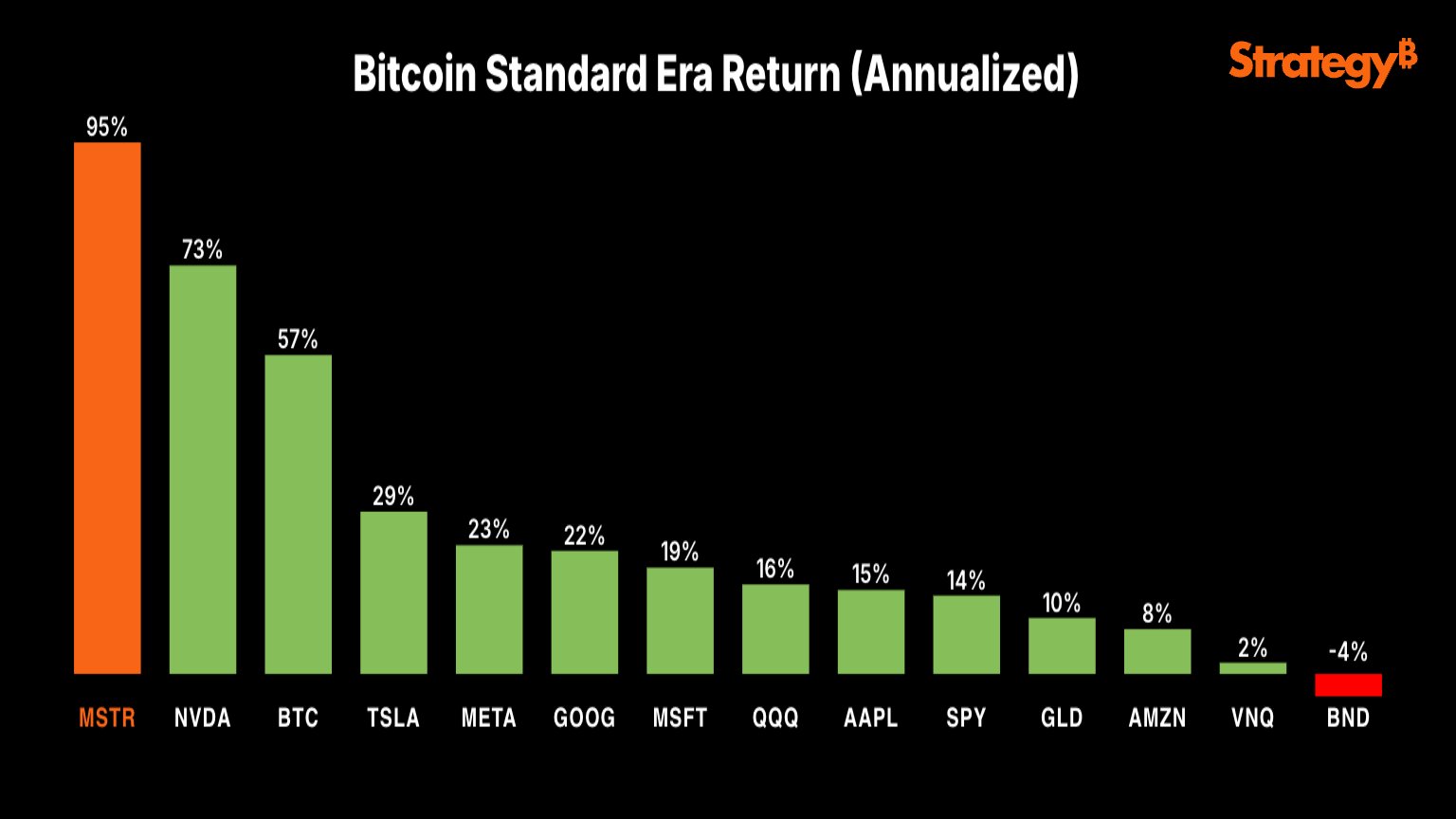

Saylor boasts that since MicroStrategy adopted a Bitcoin-centric strategy five years ago, they’ve outperformed almost every other major investment. This success has inspired other companies to follow suit.

The Spreading Treasury Strategy

Metaplanet, a Japanese firm, is also aggressively buying Bitcoin, recently adding 103 BTC to their reserves. The trend isn’t limited to Bitcoin either; some companies are building up large altcoin treasuries, like SharpLink with its massive Ethereum holdings. There are even rumors of a billion-dollar Solana buying spree by some major crypto players.

Bearish Signals?

Despite all the bullish buying, some market indicators are pointing towards a bearish trend. CryptoQuant’s Bull Score Index recently dropped, suggesting a potential shift in market sentiment. Bitcoin’s price has also seen a recent decline.

The Bottom Line

Even with bearish signals, MicroStrategy is betting big on Bitcoin. Their continued buying shows strong confidence in the long-term prospects of the cryptocurrency. Only time will tell if this strategy continues to pay off.