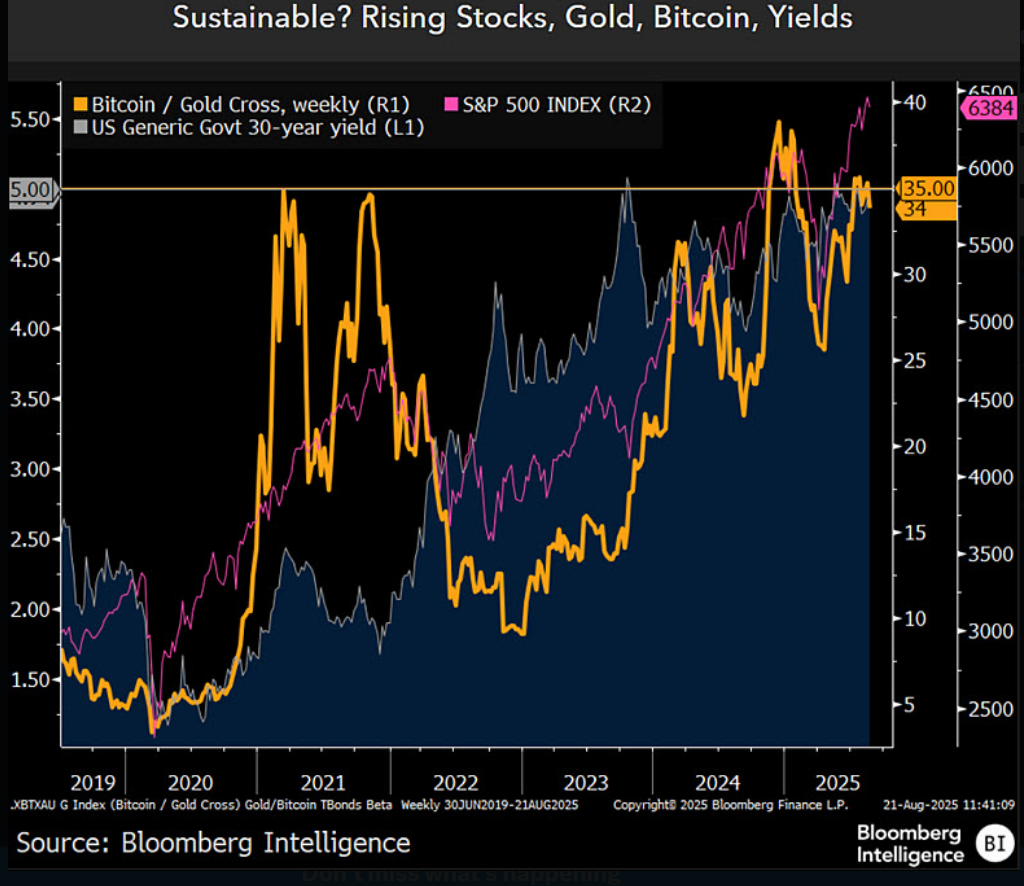

Bitcoin recently had a quick surge, but experts are worried. This rise, along with increases in stocks, Treasury yields, and gold, has some analysts concerned.

A Risky Rally?

Bloomberg Intelligence strategist Mike McGlone thinks this simultaneous rise in multiple assets is shaky. He’s worried that continued growth could fuel inflation. This could push the Federal Reserve to tighten monetary policy – the opposite of what some, like President Trump, want.

Bitcoin saw a significant drop after hitting a high of around $120,050, falling to roughly $112,990 in a short time. This shows how quickly things can change in the crypto market.

Market Reaction and the Fed

The market reacted swiftly to the Bitcoin price spike. Some investors cashed in their profits, while others reduced their holdings before important comments from the Federal Reserve at the Jackson Hole symposium. While the drop wasn’t huge historically, it highlights the market’s sensitivity. Everyone’s watching Treasury yields and Fed Chair Powell’s statements closely, as these heavily influence investment decisions.

What it Means for Investors

The recent Bitcoin price drop shows just how volatile crypto remains. A 6% swing in a few days is typical for Bitcoin, but it’s still a big deal for large investors and funds that frequently trade. Support levels around $112,000 are being closely watched.

Where Will Bitcoin Go?

Analysts are divided on Bitcoin’s future. Some predict it could hit $200,000 if certain trends continue. Others are more cautious, suggesting a peak closer to $140,000-$150,000. However, McGlone cautions that a downturn is possible if the Fed takes a tougher stance.