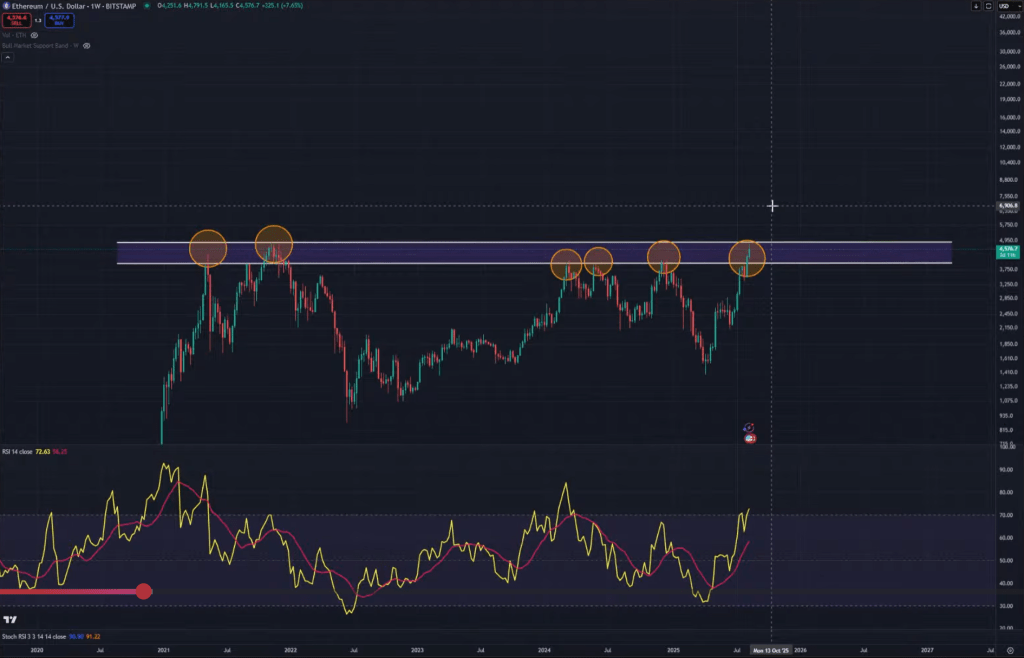

Ethereum is facing a crucial test. Analyst Kevin (@Kev_Capital_TA) calls the $4,700 price level the “make-or-break” point for the cryptocurrency. He believes Ethereum’s future hinges on whether it can decisively break through this resistance.

A Binary Situation for Ethereum

According to Kevin, there are only two possible outcomes:

- Breakthrough: A clean weekly close above $4,700, coupled with a break above the downtrending weekly RSI line, would signal the start of a significant bull run.

- Rejection: Another failure to break through $4,700 would extend the months-long pattern of weak rallies.

Kevin emphasizes that the $4,700 level isn’t just a single price point, but a supply zone representing the peak of the previous cycle. This zone has repeatedly capped Ethereum’s price increases since early 2024.

Macroeconomic Headwinds

The recent failure to break through $4,700 coincided with a hotter-than-expected US Producer Price Index (PPI). This unexpected inflation data caused a market shock, pushing Ethereum back down. Kevin explains that the PPI increase, driven by tariffs, could potentially impact the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), influencing the Federal Reserve’s interest rate decisions. The uncertainty surrounding future rate cuts significantly impacted market volatility. He highlights the upcoming Jackson Hole remarks from Fed Chair Powell as another crucial macroeconomic event.

Technical Analysis Remains Key

Despite the macroeconomic news, Kevin’s technical analysis remains unchanged. He still emphasizes two key confirmations for a bullish breakout:

- A strong break above the $4,700 resistance level.

- A break above the downtrending weekly RSI line to eliminate the bearish divergence.

Failure to meet these conditions could lead to another correction as investors sell off their holdings. Success, however, would drastically shift the market sentiment, potentially triggering a major bull run for Ethereum and other altcoins.

Broader Market Context

Kevin also points to the performance of his ETH-plus-alts proxy, Total2, which failed to break through its own resistance level. This, combined with the PPI surprise, contributed to the sharp reversal in the market. He also notes that elevated stablecoin dominance and typical September market slowdowns are additional factors to consider.

Kevin’s Advice: Patience is Key

Kevin advises against buying Ethereum at the current price levels. He recommends waiting for clearer signals before entering the market. His strategy focuses on observing the weekly Ethereum chart, the $4,700 resistance level, and the RSI trendline. He believes that a decisive break above $4,700, coupled with a positive RSI signal, is necessary to confirm a bullish trend. Until then, it’s a waiting game. At the time of writing, Ethereum was trading at $4,619.