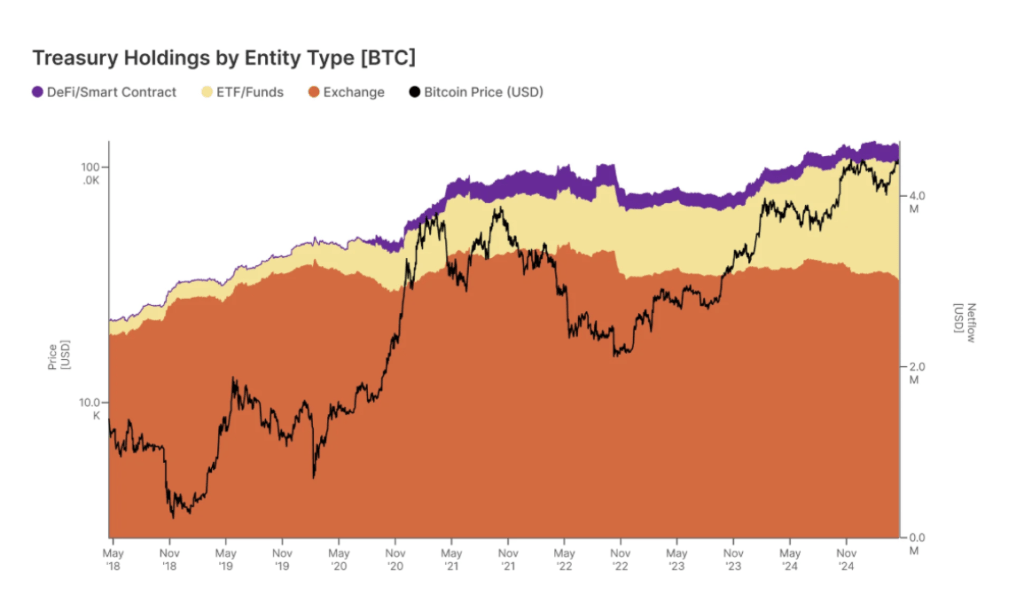

Big investors are increasingly dominating the Bitcoin market, grabbing a huge chunk of the available supply. This shift is changing how we think about Bitcoin.

Institutional Ownership Soars

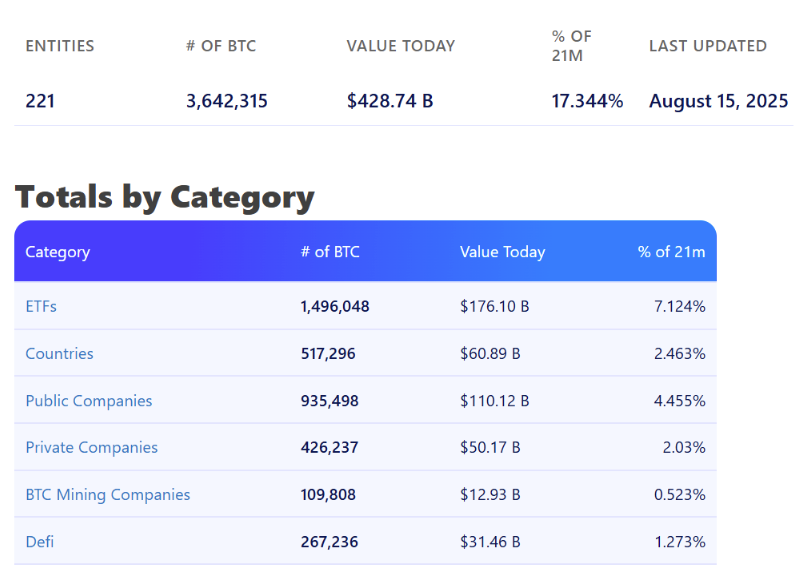

Recent data reveals that institutions – think ETFs, major companies, and even governments – now control a massive portion of Bitcoin, potentially between 17% and 31% of the total supply! That’s hundreds of billions of dollars worth of Bitcoin.

One report shows that ETFs hold the biggest piece of the pie, with over 1.49 million Bitcoin. Companies like MicroStrategy (who have been aggressively buying Bitcoin) hold a significant amount as well, around 628,946 BTC. Other institutions, including private companies, mining firms, and DeFi protocols, also own a considerable amount.

Other studies suggest the numbers could be even higher, with some estimating institutional control at over 30%! This is a massive increase compared to just ten years ago.

Is Bitcoin Decentralized Anymore?

Bitcoin’s early days were fueled by individual investors and early believers. But now, the game has changed. It’s becoming increasingly difficult for average people to afford Bitcoin, as large institutions are gobbling up the supply.

Governments are also getting in on the action. The US, for example, now has a Bitcoin reserve made up of seized assets. Other countries like El Salvador and Bhutan are also buying Bitcoin.

This massive institutional ownership has both pros and cons. Some believe it could stabilize Bitcoin’s price and boost its long-term growth. Others worry it could hurt Bitcoin’s decentralized nature and stifle price growth.

The Bottom Line

Regardless of your opinion, it’s clear that Bitcoin is now a major player in the Wall Street game. At the time of writing, one Bitcoin was worth around $117,460.