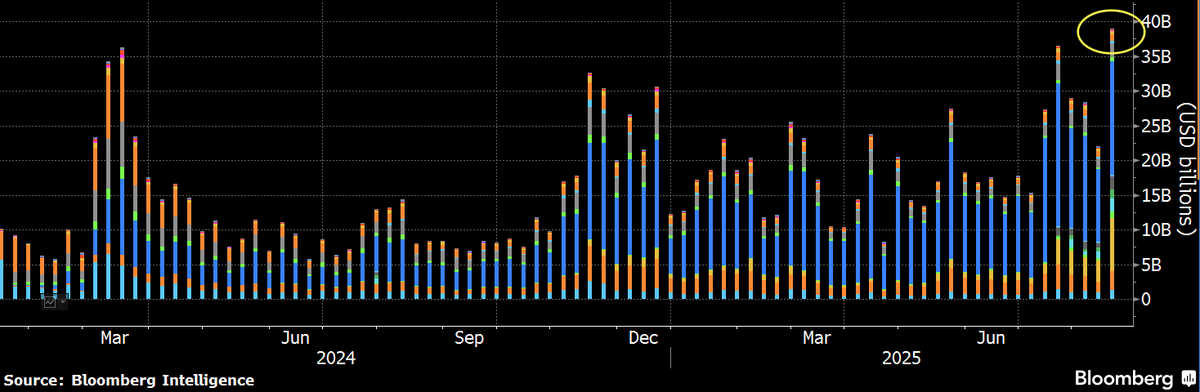

Bitcoin and Ethereum exchange-traded funds (ETFs) are having a moment. Trading volume has absolutely skyrocketed, reaching record levels.

Record-Breaking Volume

Last week alone, US-based spot Bitcoin and Ethereum ETFs saw a combined trading volume of roughly $40 billion! That’s a massive number – usually seen with top-performing ETFs or even major stocks. Ethereum ETFs were a big part of this surge, contributing around $17 billion to the total. One analyst even described the recent activity as “a year’s worth of action crammed into six weeks.”

Money is Flowing In

It’s not just about trading volume; money is pouring into these ETFs. Ethereum ETFs, in particular, have seen fourteen straight weeks of positive inflows. Last week alone, they raked in $2.85 billion! While there was a small outflow on Friday, August 15th, the overall trend is undeniably positive. Bitcoin ETFs also saw positive inflows for the week, though less dramatic than Ethereum.

Price Action Reflects the Hype

The rising popularity of these ETFs is clearly linked to the price of Bitcoin and Ethereum. Bitcoin recently hit a new all-time high of around $124,100, and Ethereum briefly touched its previous record high above $4,800. While both have seen slight dips in the last 24 hours, the overall trend remains strong.