Michael Saylor, the head of Strategy, thinks Bitcoin is about to become even more popular. He believes that potential US tariffs on gold imports could drive investors away from gold and towards Bitcoin.

Bitcoin: Tariff-Proof?

Saylor’s argument is simple: you can’t put a tariff on something that exists only online. Bitcoin, unlike gold, isn’t physical, making it immune to import taxes. Its speed and efficiency also make it a more attractive alternative. He’s not alone in this view. Simon Gerovich from Metaplanet (a Japanese company managing a Bitcoin treasury) agrees, calling gold “heavy, slow, and political,” and Bitcoin “light, fast, and free.” Metaplanet recently bought almost $54 million worth of Bitcoin, bringing their total holdings to a whopping $1.78 billion.

Market Reactions: Gold vs. Bitcoin

The market reacted differently to the tariff news. Gold futures soared to record highs as traders worried about the potential costs of new import rules. Bitcoin, however, remained relatively stable, only dipping slightly. This shows that policy changes can have unpredictable effects, pushing some investors towards traditional assets like gold, while others seek alternatives like Bitcoin.

The Long Game: Bitcoin as a Store of Value

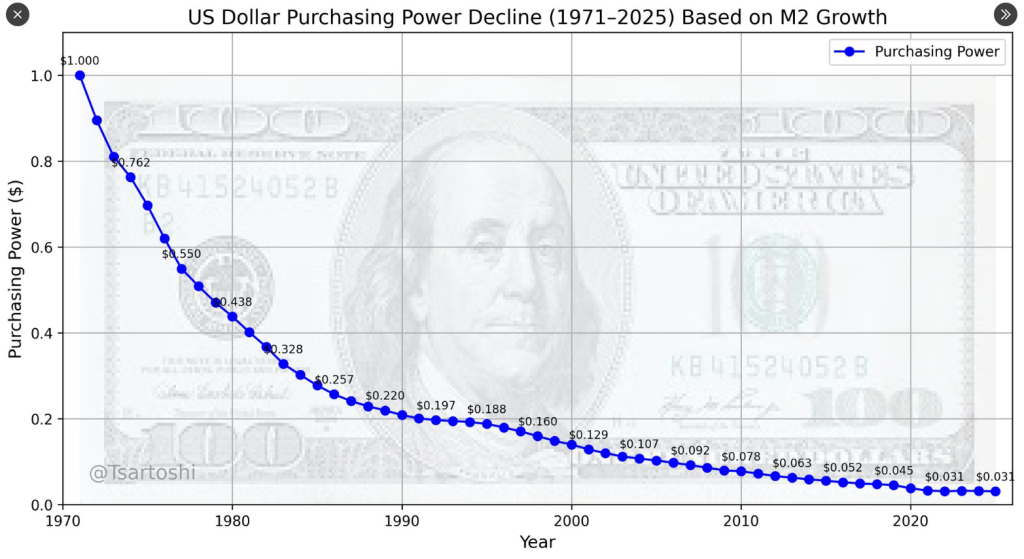

Veteran trader Peter Brandt highlighted the long-term decline in the US dollar’s purchasing power – a drop of about 95% since 1971. He argues that while gold has historically held its value, Bitcoin is now better positioned to be a reliable store of value in the future.

The Verdict?

The recent tariff talk has created some short-term market fluctuations. However, the question of whether gold or Bitcoin is the better long-term investment remains unanswered. Companies like Strategy and Metaplanet are clearly betting on Bitcoin, influencing market expectations. But gold’s recent record high shows that demand for tangible assets can surge during times of political uncertainty.