Bitcoin (BTC) took a bit of a dive recently, dropping below a key support level. Will it bounce back? One analyst says this week is crucial.

Bitcoin’s Bull Flag Falters

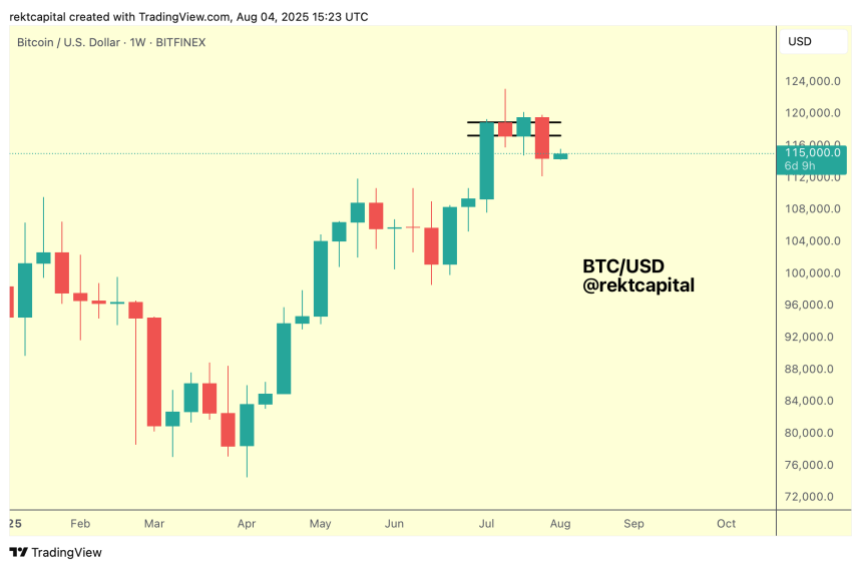

Bitcoin had been chilling in a range between $114,000 and $120,000 for a few weeks after hitting a new all-time high of $122,838. Then, it dipped below that range for the first time in three weeks, hitting a low of around $112,296. This broke a pattern analysts were watching called a “bull flag.”

This Week’s Price Action: Make or Break?

According to analyst Rekt Capital, this week’s performance is absolutely key. If Bitcoin can regain its footing and get back above the $117,200 level, the recent drop might just be a minor blip. However, if it can’t reclaim that level and stays below it, it could signal a more significant downturn, potentially leading to another drop towards $112,000.

Price Discovery Uptrend 2: Continued or Concluded?

This week also decides the fate of Bitcoin’s second “Price Discovery” uptrend. This is basically a period of significant price increases. We’re currently in week five of this uptrend, and historically, these uptrends tend to slow down around weeks 5-6.

If Bitcoin recovers and makes new highs, the uptrend continues as expected. But if it fails to close the week above the bull flag’s bottom, this second uptrend might be over much sooner than usual. That would be unusual and potentially signal a correction instead of a continuation of the upward trend.

The Bigger Picture: A Third Uptrend?

Even if this second uptrend ends early, Rekt Capital thinks there’s still plenty of time for a third. If the current uptrend underperforms, a third could make up for it. The length of any correction will determine if we see that third uptrend before a bear market hits.