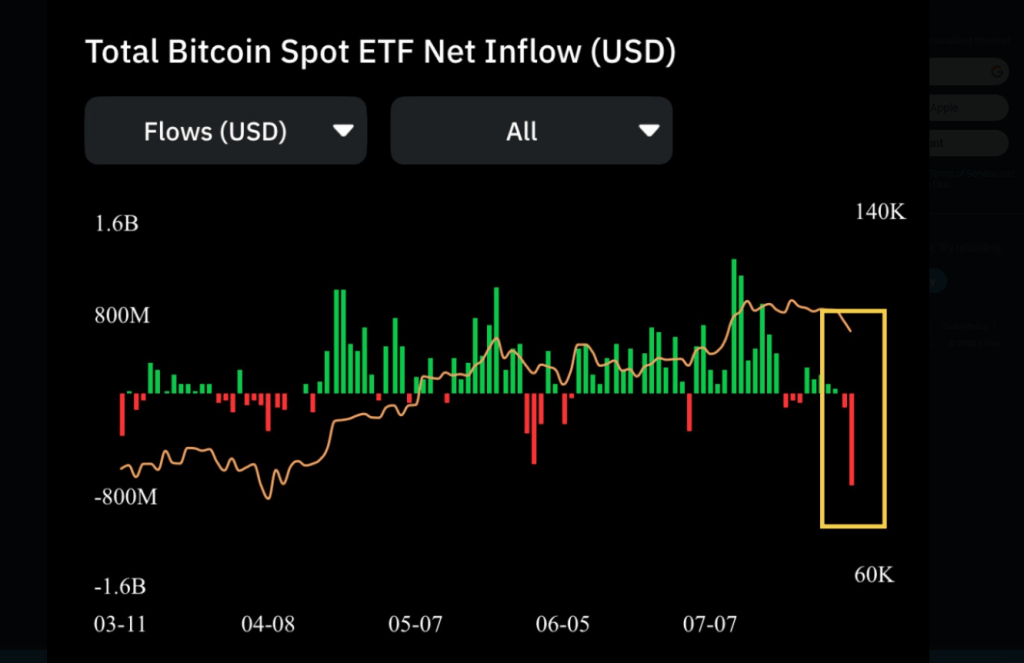

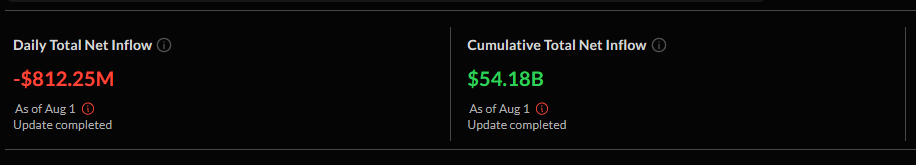

Last Friday saw a huge exodus of cash from Bitcoin exchange-traded funds (ETFs) – over $800 million! This is the second-largest single-day withdrawal ever recorded for these funds.

A Billion-Dollar Sell-Off

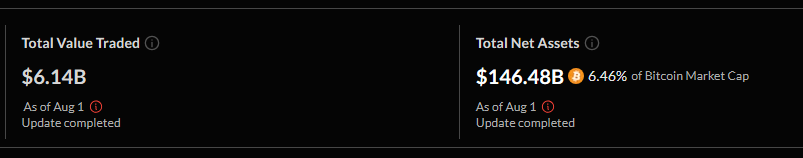

This massive sell-off wiped out a week’s worth of inflows, bringing the total net inflows down to $54 billion. Currently, all spot Bitcoin ETFs hold around $146.48 billion in assets – a mere 6.46% of Bitcoin’s total market value.

Some of the biggest losers were:

- Fidelity’s FBTC: Lost $331 million.

- ARK Invest’s ARKB: Saw $327.93 million pulled out.

- Grayscale’s GBTC: Experienced $67 million in outflows.

- BlackRock’s IBIT:

A relatively small loss of $2.58 million.

Despite the large withdrawals, it doesn’t seem like institutions are completely abandoning Bitcoin ETFs. It looks more like a strategic shift in their investments.

High Trading Volume Suggests Reshuffling, Not Abandonment

Interestingly, daily trading volume for Bitcoin ETFs spiked to $6.13 billion on the same day, with BlackRock’s IBIT alone accounting for a massive $4.50 billion. This high volume suggests investors are actively adjusting their positions, rather than completely pulling out of the market. They might be moving their money into Bitcoin futures, discounted funds like GBTC, or other crypto investments.

Ethereum ETFs Also See a Shift

The good times weren’t just for Bitcoin ETFs. Ethereum ETFs also saw a change in fortune. After a record-breaking 20-day inflow streak, they experienced net outflows of $152 million last Friday. This was led by:

- Grayscale’s ETHE:

$47.68 million outflow.

$47.68 million outflow. - Bitwise’s ETHW: $40.30 million outflow.

- Fidelity’s FETH: $6.17 million outflow.

BlackRock’s ETHA remained relatively stable, with $10.71 billion in assets under management. Total trading volume for Ethereum ETFs hit $2.26 billion. The total assets under management for all Ethereum ETFs are currently at $20 billion (4.70% of Ethereum’s market cap). It’s worth noting that just two weeks prior, these funds saw their highest ever single-day inflow of $727 million, followed by another $602 million the next day.