Bitcoin’s price is steadily rising, but this time it’s different. Unlike previous explosive rallies, the current increase is slow and controlled.

A Controlled Ascent

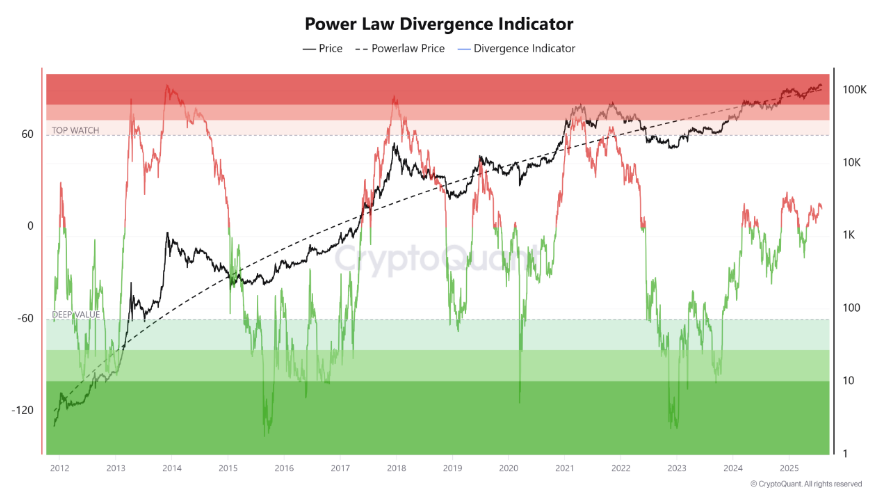

Data analysis shows Bitcoin’s price follows a predictable, gradual growth pattern. It’s currently above the expected growth line but far from overheating, unlike previous bubble periods. This suggests organic growth or perhaps the early stages of renewed investor interest.

Room for Growth?

Because Bitcoin’s price remains below the critical “red zone” that previously signaled market crashes, there’s potential for further gains. The significant gap between the current price and the recent peak suggests buyers could easily push prices higher.

Newbies Driving the Market

Interestingly, most of the recent trading activity comes from relatively new Bitcoin holders (those holding for less than 155 days). They account for about 86% of trading volume, while long-term holders are much less active, contributing only around 14.5%.

Long-Term Holders Remain Calm

This contrast between short-term and long-term holder activity is a positive sign. The fact that long-term holders aren’t selling suggests strong conviction in Bitcoin’s future. They see dips as buying opportunities, not selling signals.

Market Cooling, Not Crashing

Recent market indicators show a cooling-off period rather than an impending crash. Traders are taking profits, but there’s no widespread panic selling. This suggests a maturing market with further growth potential, but without the wild swings of previous cycles.