Could Bitcoin’s price skyrocket to $189,000? Some analysts think so.

A Simple Calculation, Big Implications

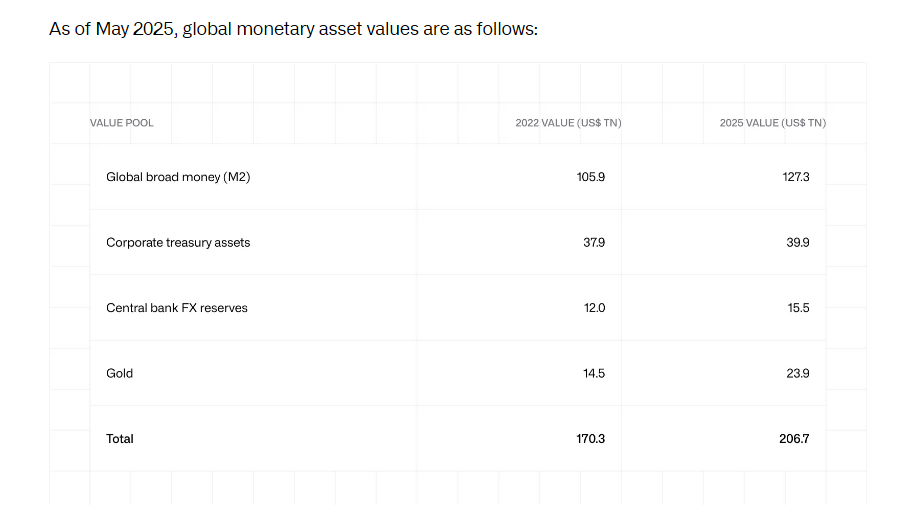

A recent report suggests Bitcoin could see a massive price increase – over 65% from its current price – if it captures even a small portion of existing global financial markets. The math is surprisingly straightforward.

Global liquidity (M2) is around $127 trillion, while the total value of all mined gold is roughly $24 trillion. The analysis uses a “Total Addressable Market” (TAM) model. If Bitcoin snags just 2% of global liquidity and 5% of the gold market, the combined value points to a Bitcoin price of approximately $189,000. This calculation doesn’t even factor in Bitcoin potentially replacing corporate treasuries or foreign exchange reserves.

Why Investors Are Excited

The beauty of this analysis is its simplicity. By looking at the sheer size of the cash and gold markets and assuming modest market share gains for Bitcoin, the potential for significant returns becomes clear. You don’t need complete market domination to make a compelling case for Bitcoin’s investment potential.

The Top-Down Approach

The TAM model starts with the big picture – the massive pools of cash, deposits, and gold. It then estimates how much of these markets Bitcoin could realistically capture. This approach is common in startup valuations. The analysis uses data from reputable sources like the World Gold Council, Trading Economics, and Glassnode to ensure accuracy.

The Roadblocks and Uncertainties

It’s crucial to remember that this is just a model. Several factors could significantly impact Bitcoin’s growth:

- Regulation: Government regulations could hinder adoption.

- Competition: New cryptocurrencies could offer competing features.

- Interest Rates: Changes in interest rates can drastically affect global liquidity.

- Gold Market Fluctuations:

The gold market’s value can fluctuate, impacting the model’s accuracy.

These uncertainties make predicting a precise timeline challenging.

The Timeline and Conclusion

The model suggests that Bitcoin could gradually increase its market share over the next decade, assuming increasing user trust, clearer regulatory frameworks, and easier institutional access. Reaching the projected 2% and 5% market share targets would require a combination of positive policy changes, continued technological innovation, and sustained investor interest. However, negative shifts in any of these areas could significantly slow or halt Bitcoin’s growth.

Ultimately, whether Bitcoin hits $189,000 is uncertain and depends on a complex interplay of factors. The TAM model, however, offers a compelling glimpse into Bitcoin’s potential if it successfully captures even a small portion of existing global financial assets.