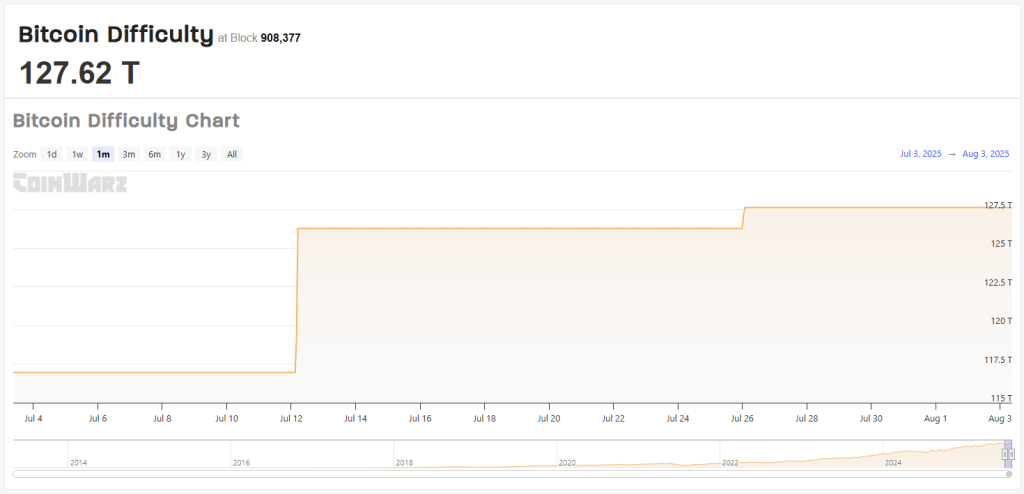

Bitcoin mining just got a whole lot harder, and the price took a hit. This week saw mining difficulty reach a record high of 127.6 trillion, according to CoinWarz. At the same time, Bitcoin’s price dropped 3%, briefly hitting a low of $113,005 before recovering slightly to around $113,250.

Record High Mining Difficulty

The difficulty is set to drop about 3% on August 9th, down to roughly 124 trillion. This happens automatically every two weeks or so, adjusting the difficulty of mining a block to keep things running smoothly. Basically, the more computing power (hashrate) miners throw at the network, the harder it gets. June saw a low of 117 trillion, but difficulty has been climbing since late July. Currently, it’s taking a little over 10 minutes to mine a block (the target is 10 minutes).

Miners Under Pressure

This higher difficulty means miners need more powerful equipment and more energy just to make a profit. With the Bitcoin price down, many less efficient operations are losing money. Only the most efficient miners are likely to survive if this combination of high difficulty and low prices continues. Mining companies carefully watch their costs; if electricity, hardware, and maintenance costs exceed their earnings, they’ll likely shut down some of their mining rigs. The upcoming 3% difficulty reduction might help some smaller players stay afloat a bit longer, but profit margins will remain tight until the price moves significantly.

Price Fluctuations

Bitcoin’s price briefly plummeted to $113,005 (a 3% drop) before recovering slightly. This rapid price swing shows how mining and market prices are interconnected. When mining becomes harder, the price can fluctuate. When the price drops, miners feel the pressure and may reduce their operations, potentially leading to easier mining difficulty in the future.