Bitcoin’s price took a dive recently, dropping below $115,000 for the first time since early July. This got people wondering if the party’s over. But some analysts think the bull run might have more legs.

Long-Term Holders Are Selling

Crypto analyst Joao Wedson recently reported that long-term Bitcoin holders (LTHs) are starting to sell off a significant portion of their holdings. He noted that about 50% of Bitcoin held in ETFs has been sold by LTHs. Despite this, Wedson still predicts the Bitcoin bull market will continue for at least two more months, with altcoins potentially extending their run for three months.

Warning Signs, But Not the End

Wedson supports his prediction with several on-chain indicators:

-

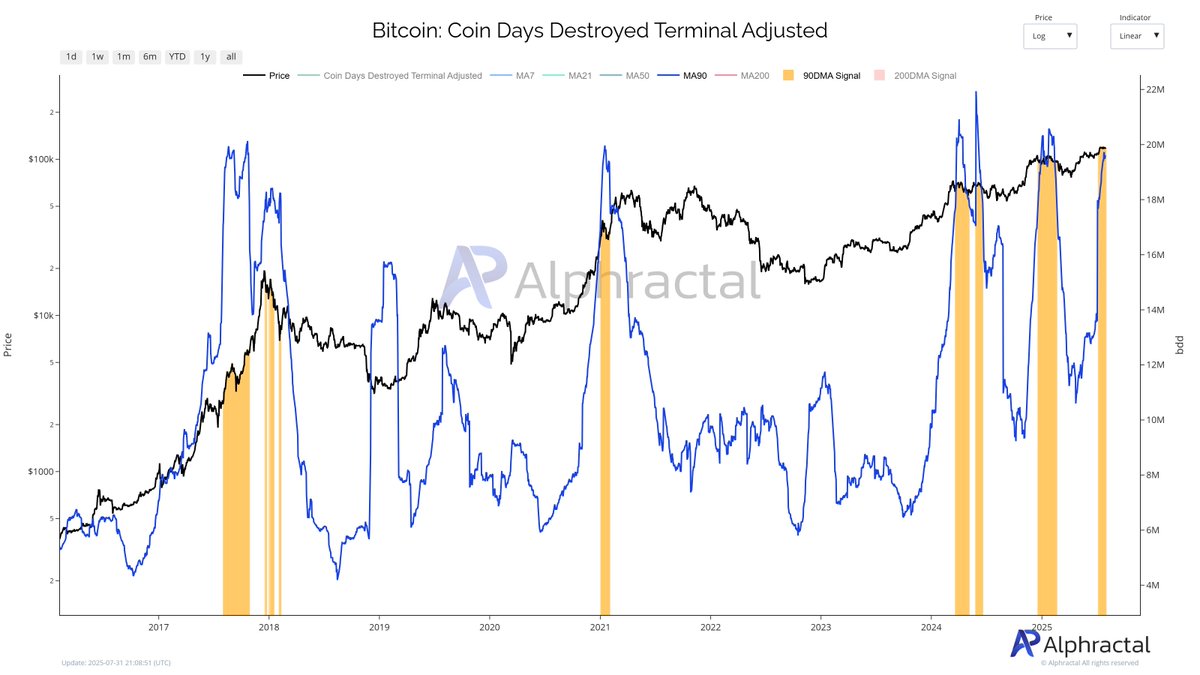

Coin Days Destroyed: This metric shows a significant movement of old, dormant Bitcoin in the last two years, triggering warning signs that often coincide with market peaks.

-

Reserve Risk: This indicator suggests increased selling pressure and trading activity among LTHs, entering a warning zone.

-

Spent Output Profit Ratio (SOPR): The SOPR recently flashed a bearish signal, indicating increased profit-taking.

-

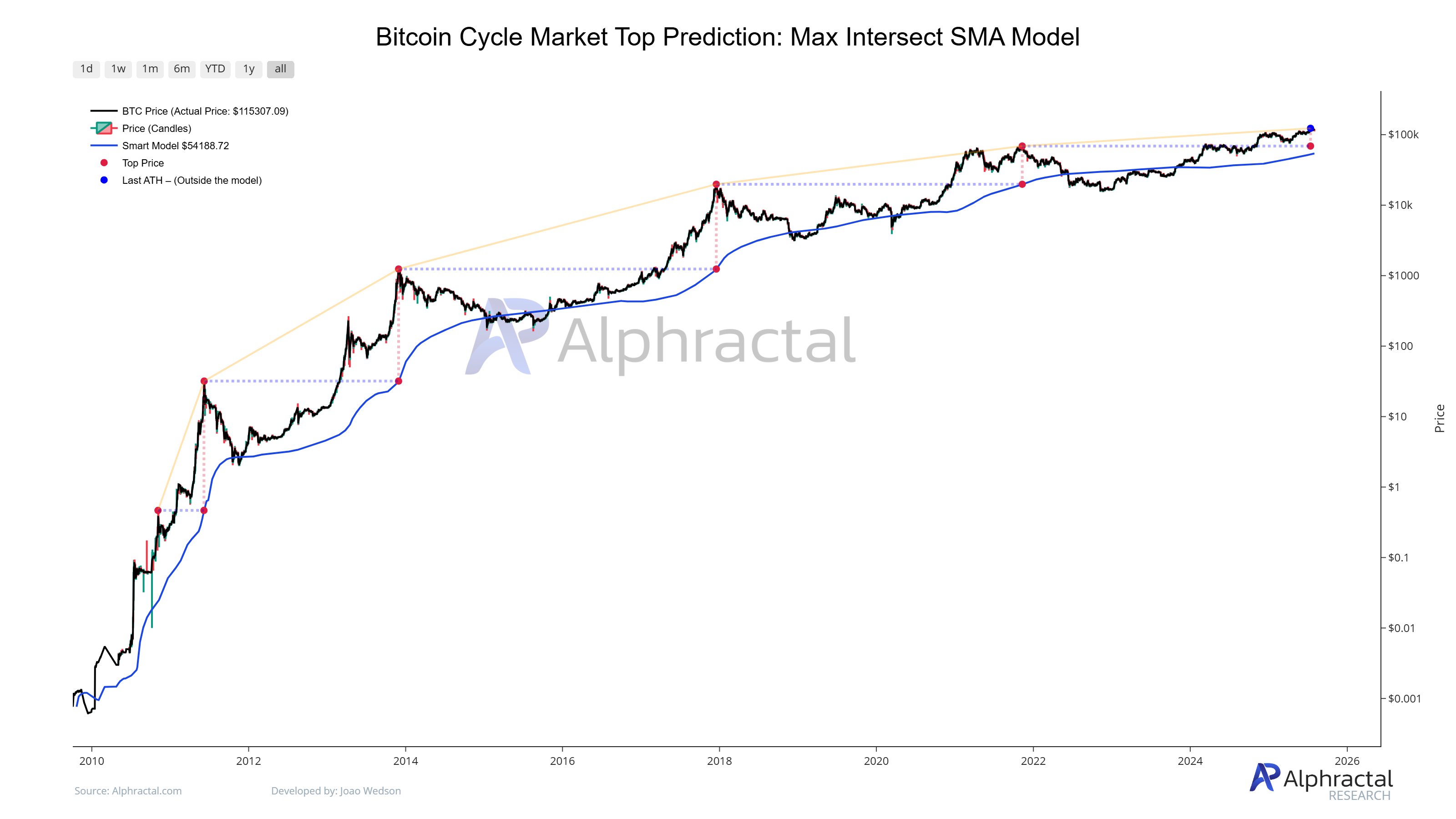

Bitcoin Cycle Market Top Prediction: Wedson considers this the most accurate metric for identifying Bitcoin’s major peaks. Importantly, this metric hasn’t signaled a bearish trend yet. Wedson points out that until it hits the $69,000 level, the final top isn’t likely here.

Don’t Panic (Yet)

Wedson advises against panic selling. Historical patterns suggest the market hasn’t reached its final peak yet. At the time of writing, Bitcoin is around $113,052, down slightly from the previous day.