Bitcoin recently hit a new all-time high above $120,000, sparking a lot of chatter about where it’s at in this bull market. While the price is exciting, looking at on-chain data gives a clearer picture. One indicator, the Satoshimeter, suggests we’re still in the middle of the cycle, with plenty of potential upside.

Mid-Cycle Momentum

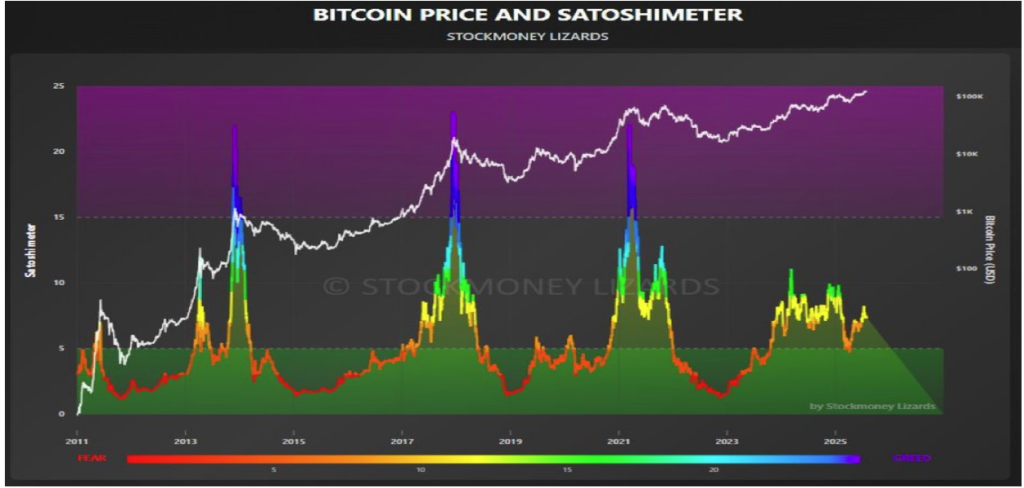

The recent price surge has everyone looking at on-chain metrics to figure out Bitcoin’s position in the current market cycle. The Satoshimeter, created by crypto analyst Stockmoney Lizard, provides a useful perspective.

According to Stockmoney Lizard’s analysis, the Satoshimeter shows Bitcoin is nowhere near the peak levels seen in past bull markets. They believe we’re in the mid-cycle phase, not the final leg of the rally.

The Satoshimeter uses on-chain data to track Bitcoin’s cyclical behavior, identifying both major bottoms and tops. Historically, readings around 1.6 have marked significant bear market bottoms (like in 2011, 2015, 2019, and 2022). Higher values have usually coincided with cycle peaks and sharp corrections.

Currently, the Satoshimeter is far from those upper extremes, meaning Bitcoin isn’t overheating. Past market tops showed massive spikes in the indicator, reflecting parabolic price action and frenzied sentiment. Now, the indicator is elevated but stable, suggesting the overall bullish trend is still intact.

$200,000? It’s Possible.

Based on the Satoshimeter’s current reading, Stockmoney Lizard predicts a continued Bitcoin price increase. While the recent jump above $123,000 is impressive, they expect a gradual rise towards a potential high of $200,000 before a significant correction.

This prediction is based on both the Satoshimeter and past cycles, where Bitcoin typically went through phases of accumulation, breakout, and parabolic growth. At the time of writing, Bitcoin is trading around $113,759, implying a potential 75%+ rally to reach $200,000.