Mara Holdings, a major player in Bitcoin mining, just raked in a whopping $950 million! This was actually an increase from their initial goal of $850 million. They sold zero-interest convertible senior notes to achieve this.

What’s the Plan for All That Cash?

So, what’s Mara planning to do with all that money? A big chunk will go towards buying even more Bitcoin. They already hold a significant amount (around 50,000 BTC, worth roughly $5.9 billion!), but they’re clearly not done yet. The rest of the funds will be used for general corporate stuff like:

- Strategic acquisitions

- Working capital

- Expanding existing operations

- Paying off some existing debt

A small portion also went towards buying back some existing convertible notes and hedging against potential dilution.

Mara’s Bitcoin Stash: A Growing Empire

Mara’s current Bitcoin holdings put them ahead of competitors like Twenty One Capital. This new cash infusion will only widen that lead. However, they still have a long way to go to catch up to Michael Saylor’s Strategy, which holds a massive amount of Bitcoin.

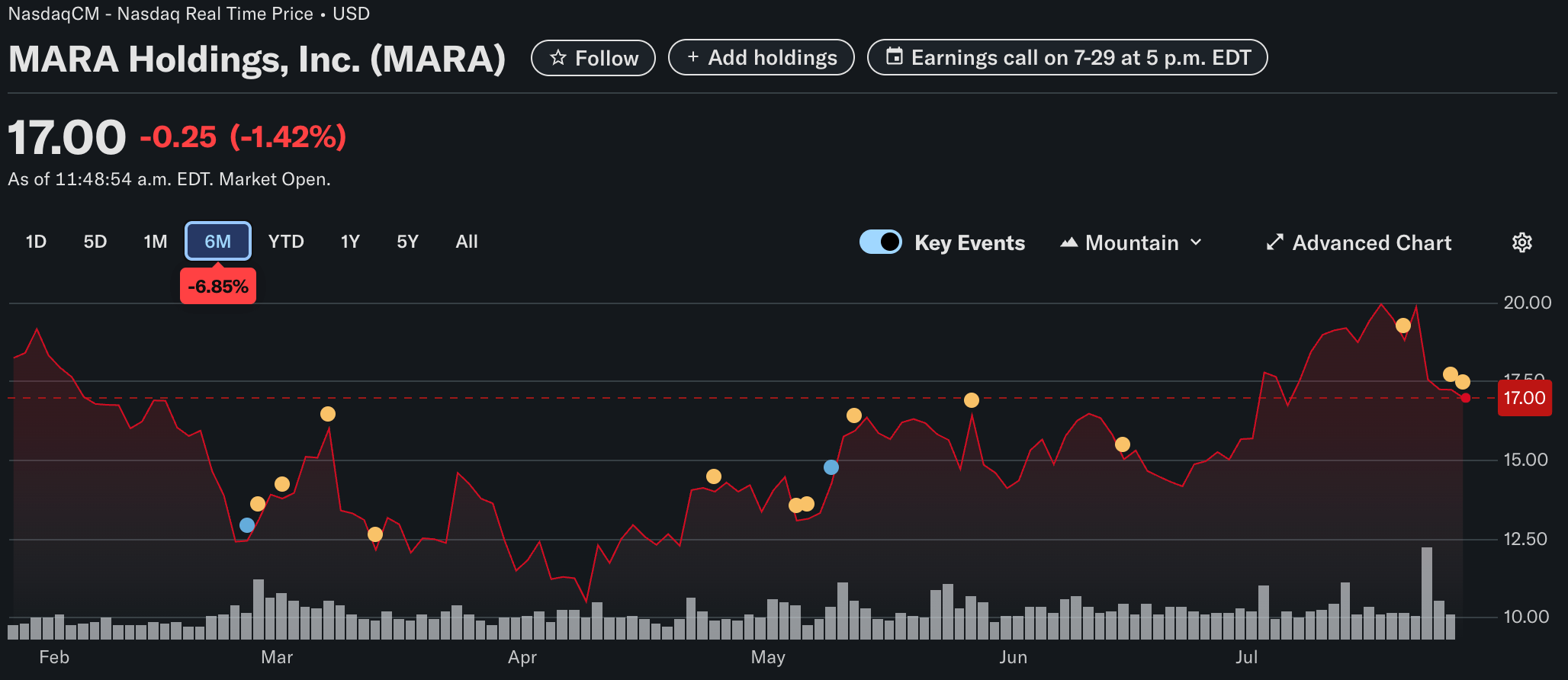

Despite the successful fundraising, Mara’s stock price took a small dip after the announcement. This is likely just short-term market fluctuation.

The Bitcoin Buying Spree Continues

Mara’s massive fundraising round highlights the growing interest from big companies in Bitcoin. It’s not just Mara; many other companies have been piling into Bitcoin recently. This shows a strong belief in Bitcoin’s long-term potential. Even Bitcoin’s recent price surge helped it surpass Amazon in market cap!