Bitcoin recently hit a new all-time high around $123,000, but then things took a turn. The price dropped, and now everyone’s wondering: is this the start of a bear market, or will Bitcoin bounce back?

Analyzing the Current Trend

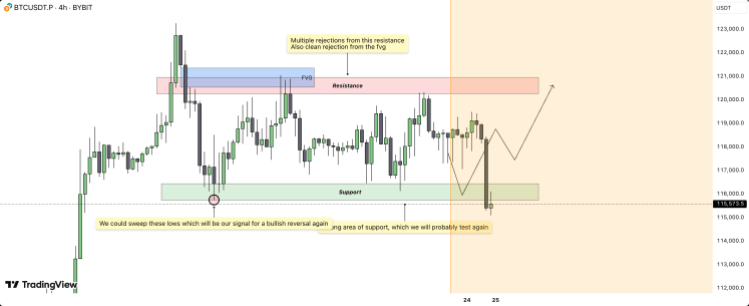

Crypto analyst TehThomas has weighed in. They see Bitcoin trading within a defined range, repeatedly rejected from the $120,000 resistance level. However, strong support around lower prices suggests significant buying pressure. This support is crucial, but also risky for buyers – a potential “sweep” back to these lows could create selling opportunities.

A key area of interest is the Fair Value Gap (FVG) at $121,000. This level has acted as strong resistance, repeatedly pushing the price back below $118,000. Reclaiming the FVG is key to a new high.

The Bounce Scenario

A dip back to lower support levels isn’t necessarily bad news. In fact, a “sweep” of these lows, followed by a bounce, could signal the start of a new uptrend. Buyers stepping in at this support level (around $116,000) would be a bullish sign. The FVG could then act as a magnet, pulling the price higher.

The Breakdown Risk

However, there’s always the risk of a breakdown. If the $116,000 support fails and there’s no quick recovery, the bullish outlook is invalidated.

The Bottom Line

Currently, Bitcoin is stuck in a range. Until a clear breakout happens, the best trading opportunities lie at the edges of that range. The next few days will be crucial in determining whether Bitcoin bounces back or continues its downward trend.