It’s mid-2025, and the crypto and traditional financial markets have been on a wild ride. Global events have created a strong link between them, even though Bitcoin and US stocks haven’t always moved in sync lately. But there’s definitely a connection.

Decoding the Volatility Index (VIX) and Bitcoin

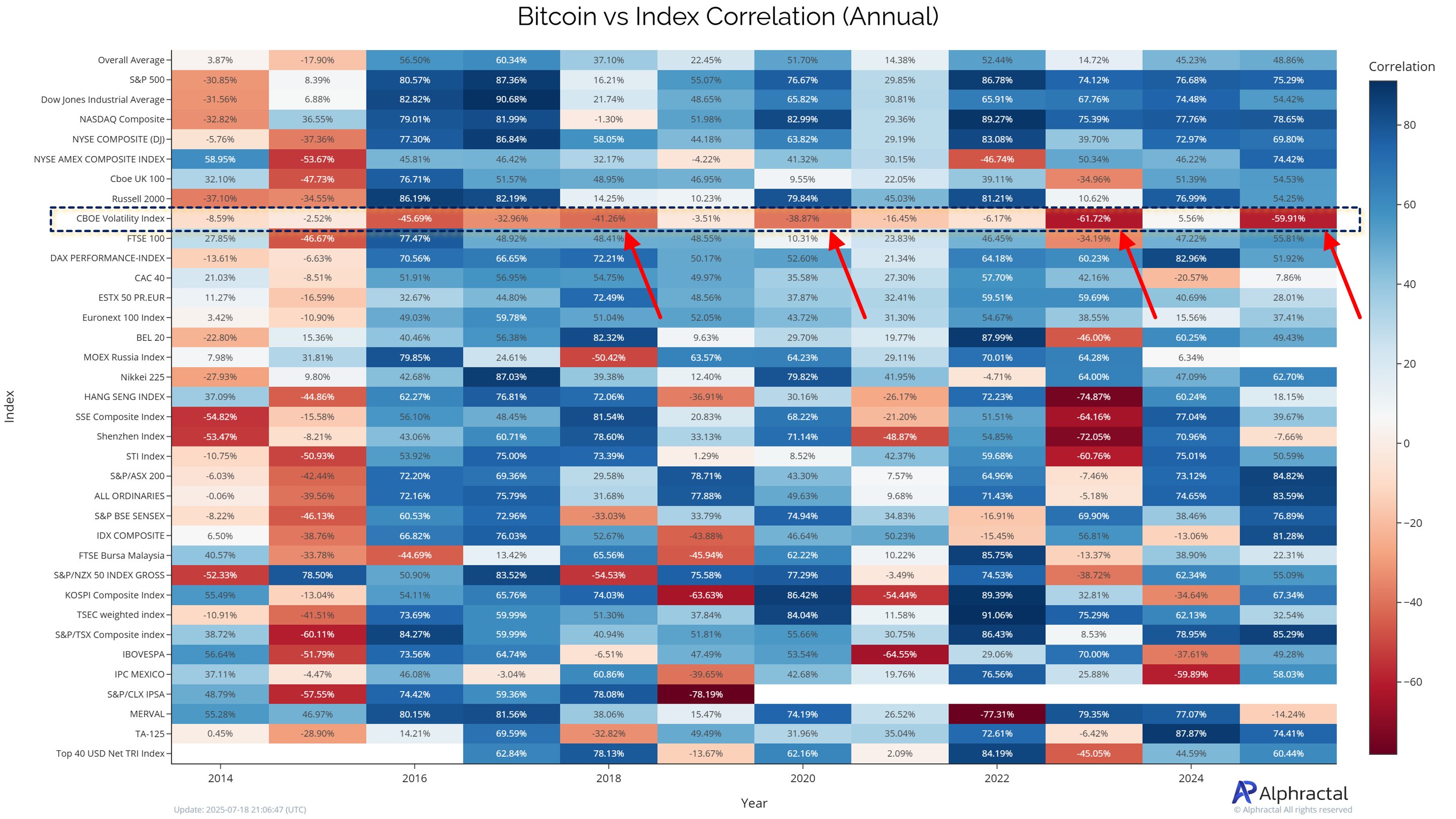

Joao Wedson, CEO of Alphractal, recently shed light on the relationship between Bitcoin and the US stock market, specifically using the S&P 500 and its volatility, measured by the VIX. The VIX, often called the “fear index,” shows how much investors expect the S&P 500 to fluctuate. High VIX means more fear and uncertainty.

Wedson points out a key insight: when Bitcoin’s correlation with the VIX is low or negative (meaning they move in opposite directions), Bitcoin often sees significant price increases in the following year, especially when the VIX is low. This is because Bitcoin acts more independently.

High VIX vs. Low VIX: What to Watch

Wedson explains that during times of high VIX (lots of fear in the stock market), it’s worth looking at the relationship between Bitcoin and US equities, as the stock market’s fear can impact Bitcoin. However, with the VIX currently falling, the S&P 500 might not be a good indicator of Bitcoin’s next move.

In short: Don’t focus too much on how Bitcoin relates to the S&P 500 when the VIX is low or negative. That’s often when Bitcoin takes off.

Bitcoin’s Growing Independence

Wedson concludes that Bitcoin’s decreasing correlation with traditional market volatility (as measured by the VIX) is a positive sign for its future as an independent asset. This could mean good things for Bitcoin’s price and offer exciting opportunities for investors.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $117,888, with little change in the last 24 hours.