Bitcoin recently hit a high above $120,000, prompting a massive sell-off by the very people who mine it. This is causing some concern about the future of the rally.

Miners Dumping Bitcoin

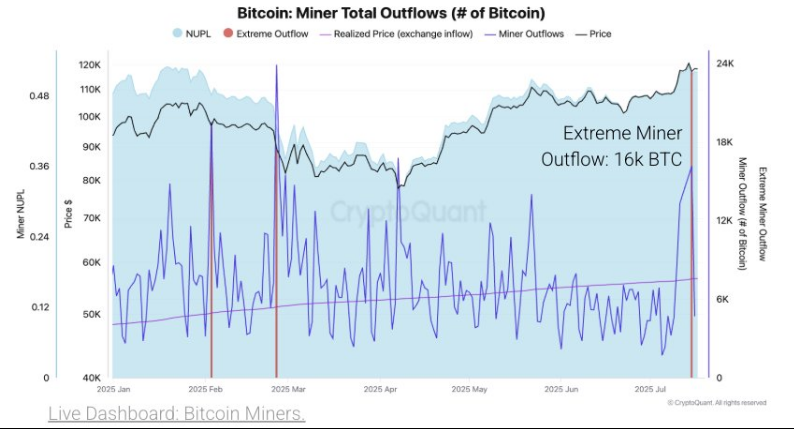

On July 15th, miners sent a whopping 16,000 Bitcoin to exchanges – the highest single-day amount since April. This huge outflow suggests miners are taking profits from the recent price surge. This kind of sudden increase in supply can put downward pressure on prices, at least temporarily.

This isn’t the first time this has happened. Earlier this year, during Bitcoin’s climb from $75,000 to over $100,000, miners sold around 17,000 Bitcoin in April alone. Miners typically sell when they’ve covered their costs and can make a significant profit. However, when many miners sell simultaneously, it can create market volatility.

Not Just the Big Guys

It’s not just the biggest miners selling. Wallets holding between 100 and 1,000 Bitcoin have also been offloading their coins. They’ve sold about 3,000 Bitcoin since mid-June. This adds to the overall supply hitting the market.

Exchange Inflows Exploding

The amount of Bitcoin sent to exchanges has also increased dramatically, quadrupling from around 13,000 Bitcoin per day to approximately 58,000 Bitcoin this week. This shows that many people are taking profits and selling their Bitcoin.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $118,000, slightly down from its recent peak. Whether this sell-off signals the end of the rally remains to be seen.