Bitcoin recently hit a new all-time high after hovering around $100,000-$110,000. A closer look at on-chain data reveals a fascinating shift in how different Bitcoin holders behaved, likely driving this price action.

Long-Term Holders (LTHs) and Short-Term Holders (STHs): A Shift in Behavior

On-chain analyst Boris highlighted a key change in the market: Long-Term Holders (those holding Bitcoin for a longer period) and Short-Term Holders (those holding for shorter periods) acted in opposite ways. They analyzed wallet activity to see if these groups were buying (accumulating) or selling (distributing) Bitcoin.

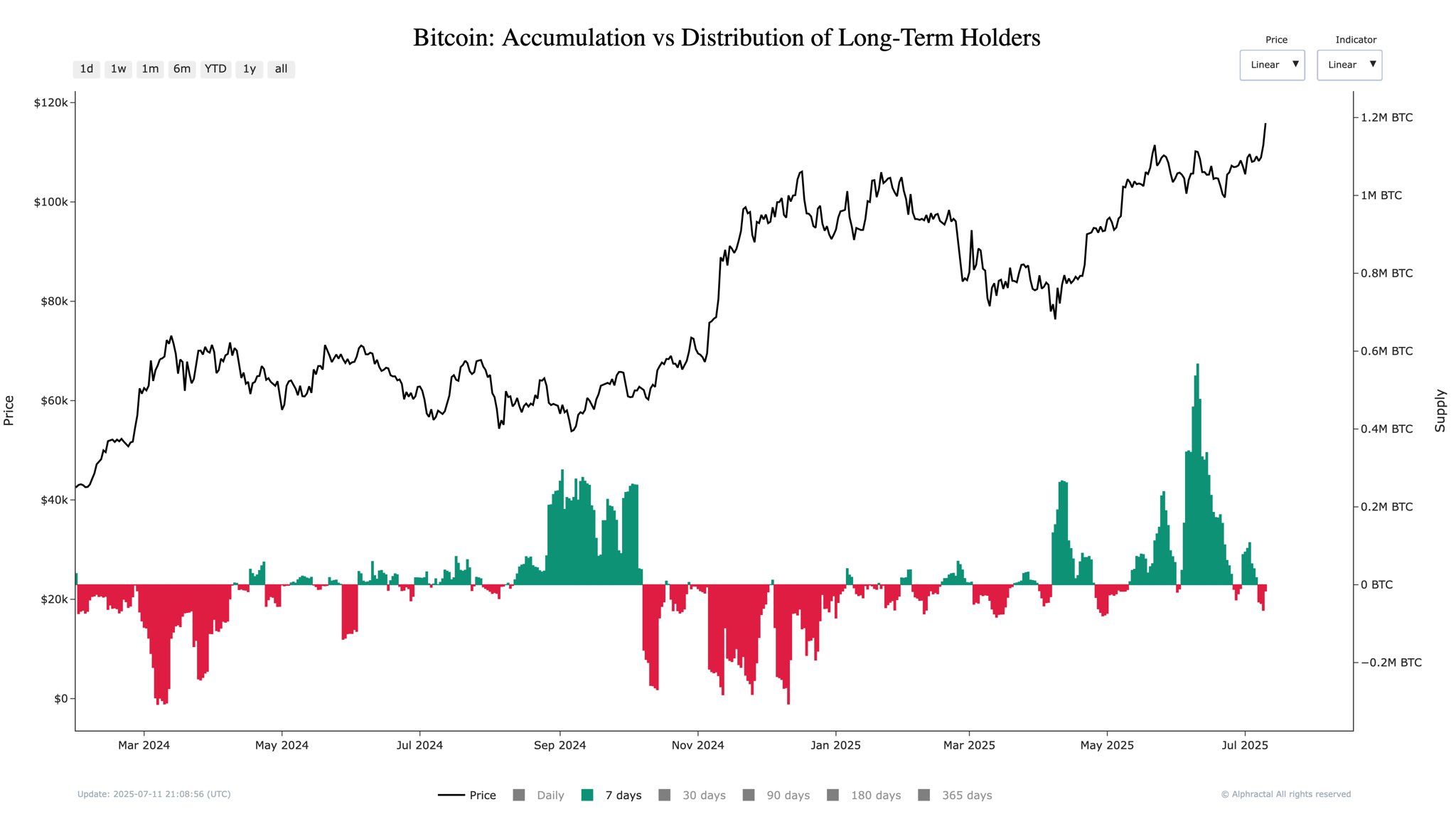

LTHs: From Accumulation to Distribution

Initially, LTHs were accumulating Bitcoin, significantly from late May to the end of June. This accumulation helped Bitcoin stay above the crucial $100,000 support level, even as Short-Term Holders were selling off. Boris noted that LTHs absorbed much of the selling pressure from STHs, who sold over 563,000 BTC during this period.

However, recently, LTHs started distributing their Bitcoin, likely taking profits after the price increase.

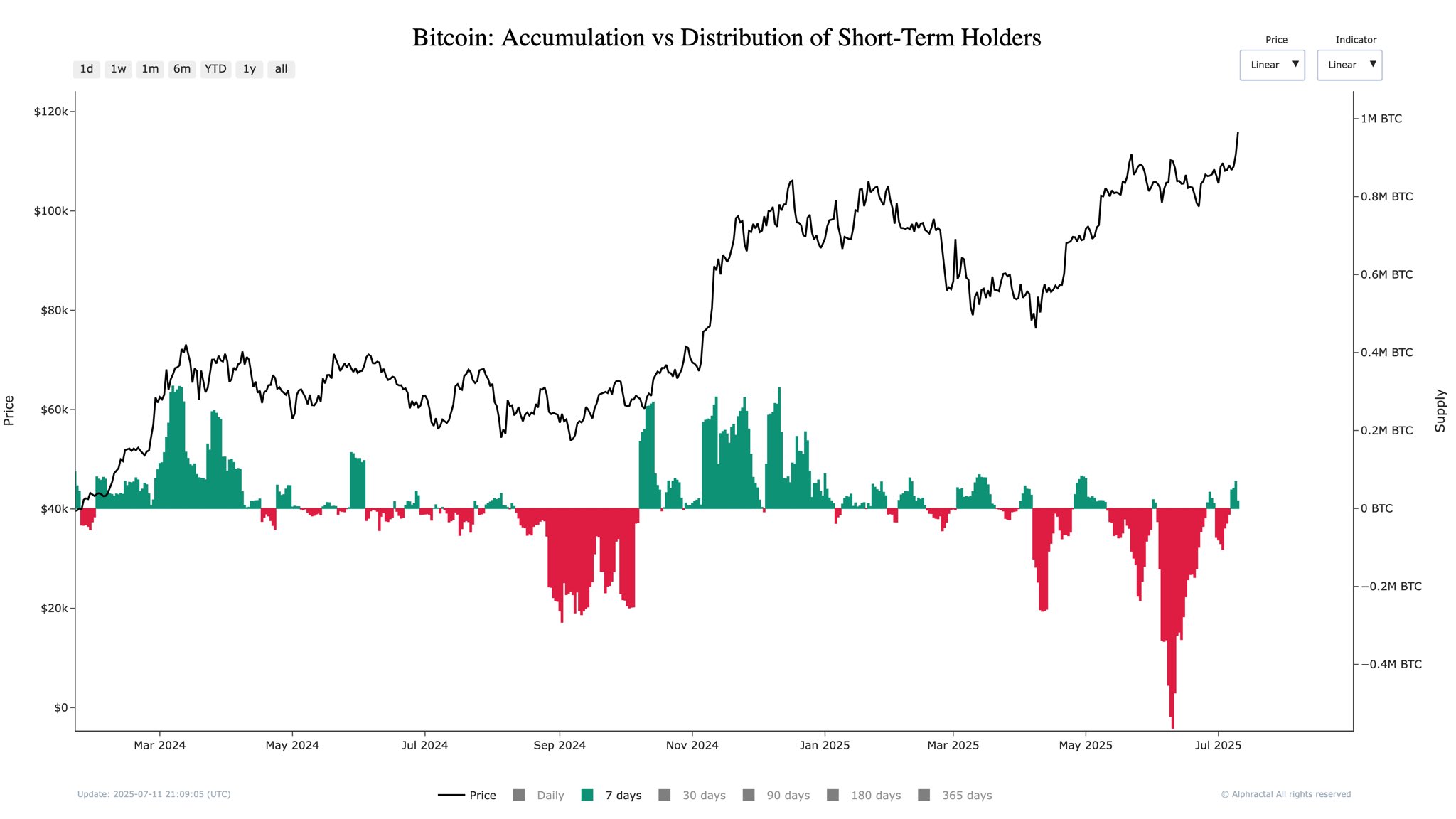

STHs: From Distribution to Accumulation

Conversely, Short-Term Holders, who were initially selling, have recently begun accumulating Bitcoin. This suggests renewed retail interest and speculation during the current bull run.

The Handoff and Bitcoin’s Breakout

The shift from LTH support to STH support seems to have fueled Bitcoin’s recent breakout. The influx of short-term buying momentum injected energy into the market.

What’s Next for Bitcoin?

While shifts between holder groups are normal in crypto markets, the scale and timing of this recent change suggest exciting possibilities for Bitcoin’s price. However, if short-term buying slows down and LTH support isn’t there, Bitcoin could see a price drop and retest lower support levels. At the time of writing, Bitcoin is trading around $117,300.