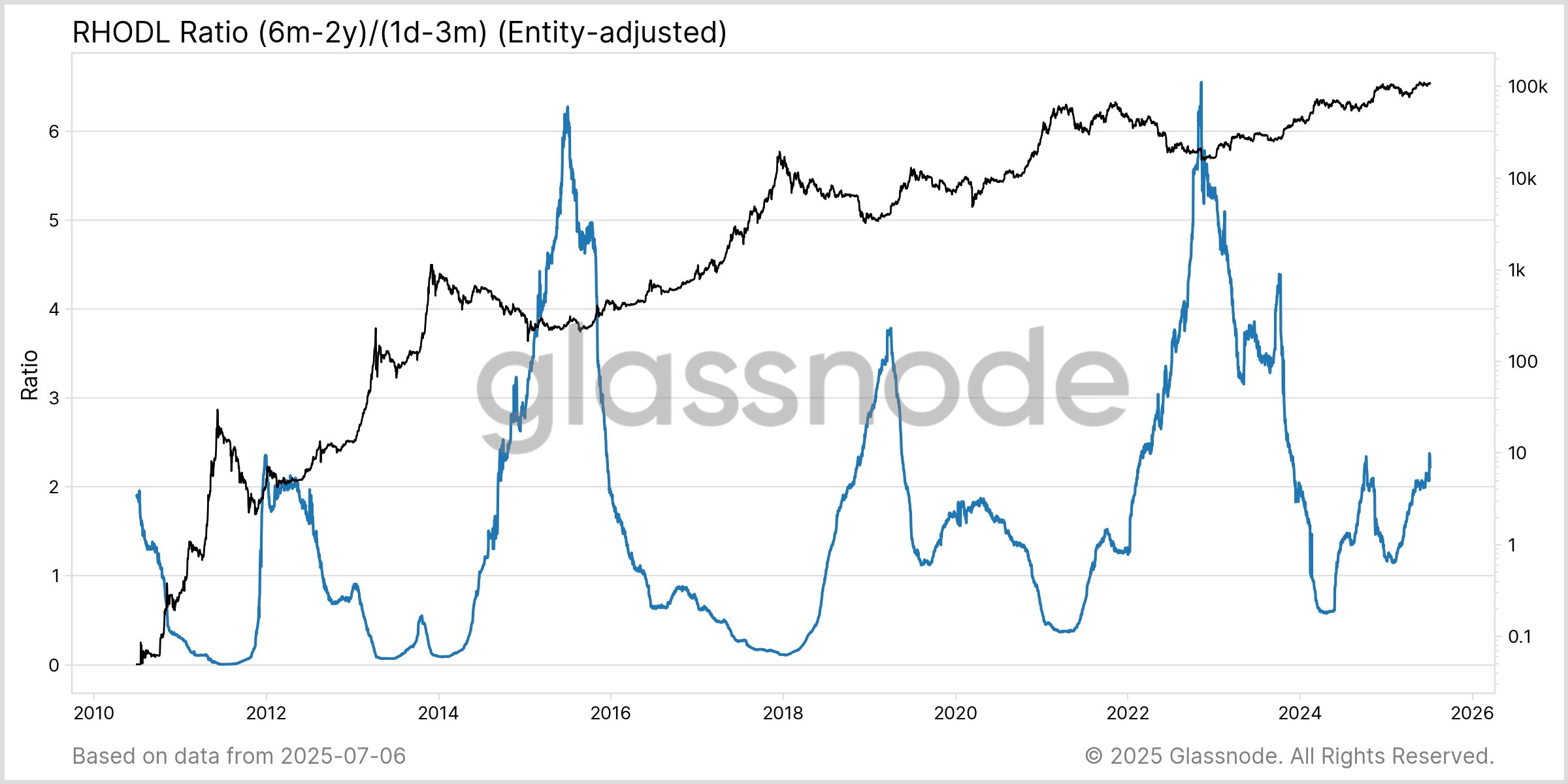

Bitcoin’s price action can be confusing, but luckily, we have on-chain data to help us understand what’s happening. One metric, the RHODL Ratio, is flashing a potential warning sign.

What is the RHODL Ratio?

The RHODL Ratio compares two groups of Bitcoin holders:

- Short-term holders: Those who’ve held Bitcoin for 1 day to 3 months. Think of them as newer investors.

- Long-term holders: Those who’ve held Bitcoin for 6 months to 2 years. These are your seasoned investors.

The ratio looks at how much money each group controls. A rising ratio means long-term holders are accumulating more Bitcoin, while short-term holders are holding less.

The RHODL Ratio is Rising: What Does it Mean?

Recently, the RHODL Ratio has been climbing. This suggests a shift: long-term holders are gaining dominance. Historically, this pattern has appeared before Bitcoin transitions

[Insert chart here if available]

Glassnode, a cryptocurrency analytics firm, points out that while the ratio is up, it’s still far from its all-time highs. So, it’s too early to definitively say a bear market (a period of falling prices) is here. This could be a temporary blip or the start of a significant trend.

Bitcoin’s Current Price

At the moment, Bitcoin is trading around $109,300, a slight increase from last week. However, this price alone doesn’t tell the whole story. The RHODL Ratio adds another layer of information to consider.