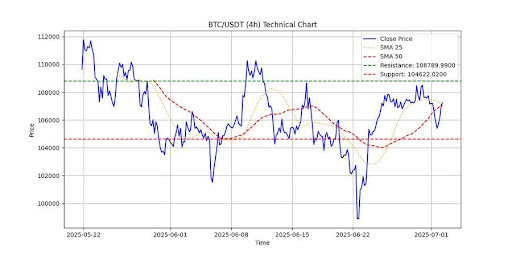

Bitcoin is hanging around $107,000, slightly above some important average prices (moving averages). While this shows some underlying strength, it’s not clear where it’s headed next. The market’s a bit on edge.

Mixed Signals: What Do the Indicators Say?

Several indicators paint a picture of uncertainty. The Relative Strength Index (RSI) is at 53, which is neutral – neither suggesting a big price increase nor a big drop. The Average Directional Index (ADX) is low, meaning there’s not a strong trend pushing the price up or down. The MACD is negative, but not dramatically so.

Despite this indecisiveness, trading volume is up. This suggests traders are anticipating a significant price change, either up or down.

Key Price Levels to Watch

Bitcoin faces resistance around $108,790. Breaking through this would signal a bullish trend. On the flip side, support sits around $104,622. Falling below this could lead to further price drops.

The Bottom Line

Bitcoin’s price is currently in a holding pattern. Increased trading volume suggests a move is coming, but the direction remains unclear. Keep an eye on the resistance and support levels mentioned above to get a better idea of where the price might go next.