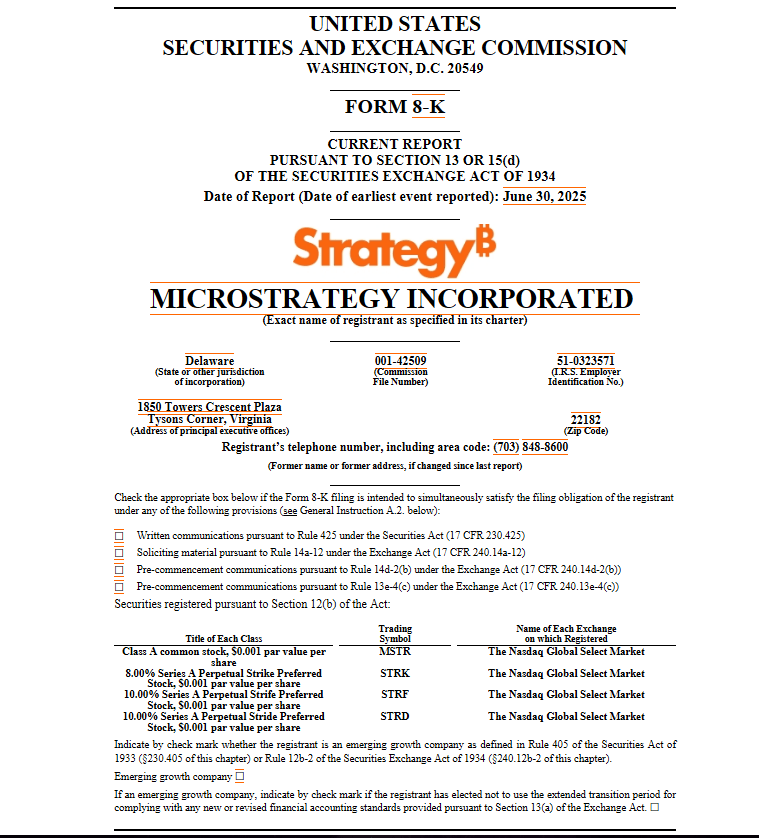

Michael Saylor’s company, MicroStrategy (now Strategy), just went on another Bitcoin buying spree!

Another Big Bitcoin Buy

They added a whopping 4,980 Bitcoin to their collection, spending roughly $531 million. That brings their total Bitcoin holdings to a staggering 597,325 BTC! At current prices, that’s worth over $64 billion – a huge profit considering they’ve only invested about $42.4 billion. As of June 30th, their unrealized gains are nearly $21.6 billion.

Strategy’s Bitcoin Game Plan

Strategy’s been aggressively buying Bitcoin. They purchased 88,062 BTC (almost $10 billion worth) this year alone! In 2024, they bought even more – 140,538 BTC for $13 billion. Their Bitcoin investments are paying off, with a year-to-date yield of almost 20%, and 7.8% in the second quarter. They’re aiming for a 25% yield by the end of 2025.

A Major Bitcoin Holder

Strategy now owns almost 3% of all Bitcoin ever mined! This has inspired other companies to follow suit, with over 134 publicly traded firms now holding Bitcoin in their corporate treasuries. Recent examples include Trump Media and GameStop. Even companies in Japan and Europe are joining the trend.

The Ripple Effect: New Products and Price Action

The increased demand for Bitcoin is driving innovation. Gemini, for example, recently launched a tokenized version of Strategy’s stock in the EU. Strategy’s stock price itself has also seen a recent increase.

Bitcoin’s price is hovering around $108,000. While some analysts predict a slight dip before another price surge, the potential for Bitcoin to break through $110,000 and beyond is definitely there.