Bitcoin spot exchange-traded funds (ETFs) in the US saw a massive surge in investment last week. Let’s break down the numbers.

A Week of Big Gains

Over $2 billion flowed into these Bitcoin ETFs, extending a three-week winning streak. This is a huge turnaround from the first week of June, which actually saw some money leaving. But the overall picture is incredibly positive: a total of $4.63 billion poured in over the past three weeks. This positive trend has now lasted for 14 straight days!

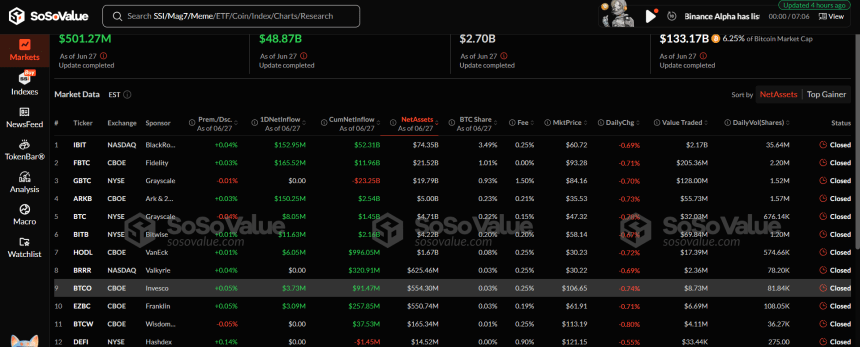

BlackRock Leads the Charge

The BlackRock IBIT ETF was the star performer, attracting a whopping $1.31 billion. Fidelity’s FBTC and Ark/21 Shares’ ARKB also saw significant inflows, with $504.40 million and $268.14 million respectively. Other ETFs like Grayscale’s BTC, VanEck’s HODL, and others also saw smaller but still notable increases. Only Grayscale’s GBTC saw outflows, losing $5.69 million.

Institutional Investors Show Strong Belief

June’s total inflows for US Bitcoin spot ETFs reached a staggering $4.5 billion. This shows strong confidence from institutional investors, even with Bitcoin’s price fluctuating between $100,000 and $110,000 recently. While the price hasn’t hit new highs, this massive investment suggests a long-term bullish outlook.

Ethereum ETFs Also Shine

It wasn’t just Bitcoin ETFs seeing the love. Ethereum spot ETFs also had a great week, adding $283.41 million in new investments, extending their positive streak to seven weeks. June was a record month for them, with $1.13 billion in total inflows. Their total assets now stand at $9.88 billion.