Bitcoin’s price has been stuck in a tight range recently, hovering around $106,000-$107,000. This isn’t just random price action; there’s a fascinating story unfolding behind the scenes.

Liquidation Zones: The Price Battleground

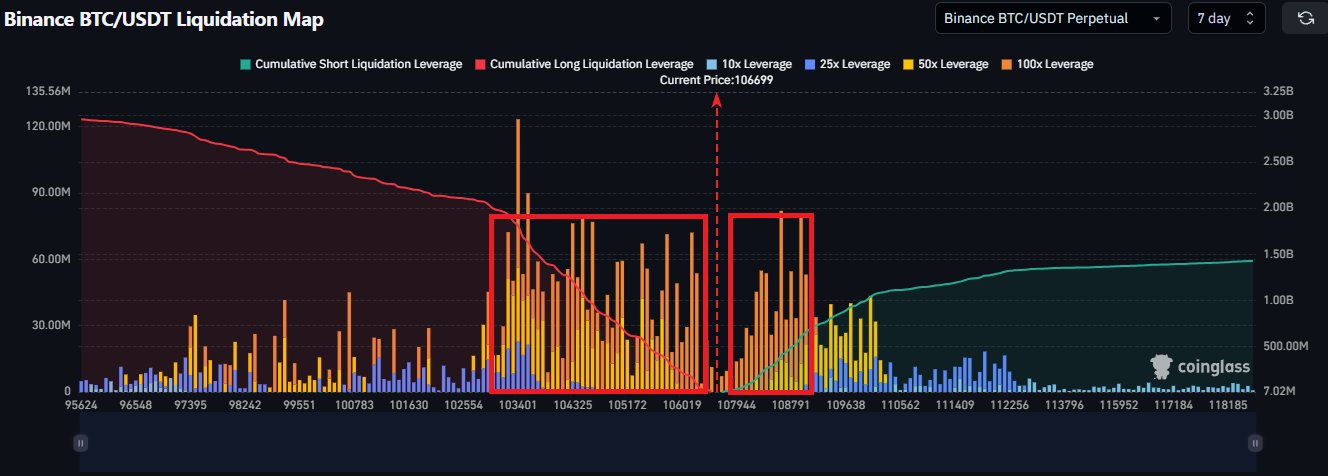

Crypto analyst KillaXBT has pointed out some crucial “liquidation zones” that are influencing Bitcoin’s price movement. These are price levels where a lot of traders have placed bets (either buying or selling), and if the price breaks through these zones, a wave of forced selling (or buying) could occur.

Short-Term Outlook (7-Day Chart)

Looking at the past week, KillaXBT highlights two key areas:

- $103,400 – $106,000: A significant number of traders have bet on Bitcoin going up. If the price falls below this range, these traders could be forced to sell, potentially causing a price drop.

- $108,000 – $109,000: Conversely, many traders have bet on Bitcoin going down. A price break above this range could trigger a “short squeeze,” where these traders are forced to buy, potentially pushing the price higher.

Long-Term Outlook (30-Day Chart)

Zooming out to a longer timeframe, the picture is still somewhat balanced, but leans slightly towards the short side. While there are more short positions clustered between $108,300 and $109,000 than long positions between $103,000 and $106,000, a strong push above $111,000 could change the game completely.

What This Means for Traders

KillaXBT’s analysis suggests a market in a state of limbo. High-leverage positions are stacked on both sides of the current price, making it a risky time to trade. The analyst advises waiting until these key liquidation zones are tested before making any significant moves.

Bitcoin Market Summary

At the time of writing, Bitcoin is trading slightly above $107,000, with daily trading volume down considerably. This suggests less market activity. Interestingly, despite lower network fees and on-chain activity, a significant amount of Bitcoin is moving off exchanges and into private wallets. This could indicate that investors are holding onto their Bitcoin for the long term, suggesting confidence in the asset./p>