Is Bitcoin about to explode? A crypto analyst thinks so, pointing to a fascinating historical pattern.

Post-Halving History Suggests a Q3 Rally

Every four years or so, Bitcoin undergoes a “halving,” cutting the reward for miners in half. Interestingly, the third quarter (Q3) of the year following a halving has historically seen some serious Bitcoin price increases. One analyst, Luca, recently highlighted this trend on X (formerly Twitter).

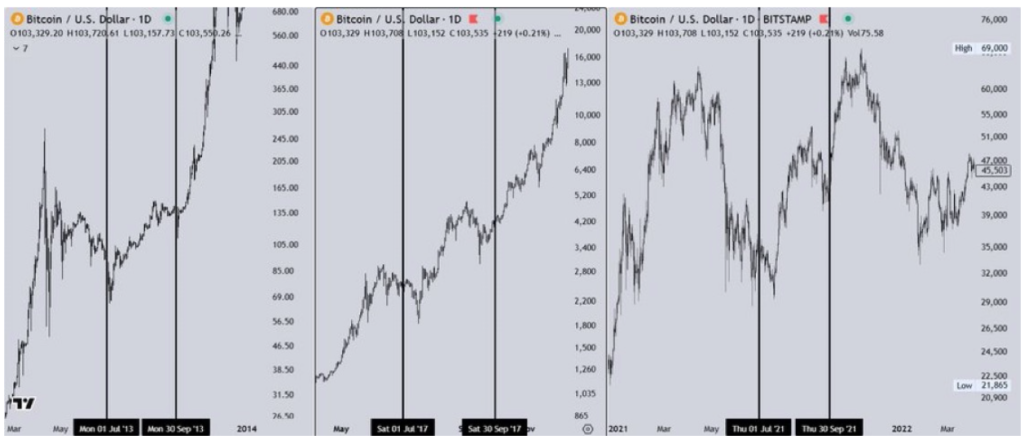

Luca’s analysis shows that in the post-halving Q3s of 2013, 2017, and 2021, Bitcoin experienced significant price rallies.

- 2013: Bitcoin went from under $100 in July to over $680 in November.

- 2017: A jump from under $2,800 in early Q3 to over $16,000 by year’s end.

- 2021: A recovery rally taking Bitcoin from under $39,000 in July to over $69,000 in November.

This consistent pattern leads Luca to believe a similar rally is likely in 2025.

A $140,000 – $160,000 Prediction

Based on technical analysis (specifically, Fibonacci Extensions), Luca predicts Bitcoin could reach a cycle top between $140,000 and $160,000 by the end of Q3 2025. That’s a potential increase of 30% to almost 50% from the current price!

While he acknowledges that this is just a prediction and things could change, the overall picture, according to Luca, remains bullish. Even a short-term dip wouldn’t necessarily change the long-term positive outlook.