Bitcoin’s price has been pretty flat lately, but something interesting is happening in the futures market. This could signal a big shift, potentially wiping out the bears.

A Strange Spike in Liquidations

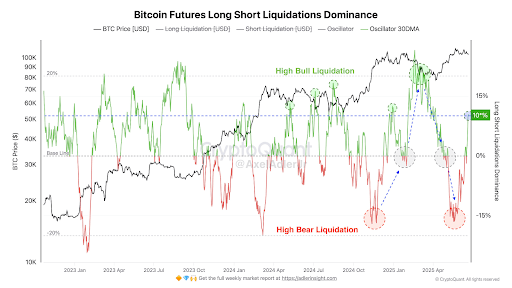

CryptoQuant analyst Axel Adler Jr. noticed a huge jump in “long liquidation dominance.” This means a lot of traders betting on Bitcoin going up are getting forced to sell. Normally, this would cause a price crash. But this time, Bitcoin’s price stayed relatively stable, hovering around $103,000 to $106,000. This is unusual and suggests strong buyer support.

Adler points out that similar spikes in long liquidations in the past have been followed by bullish reversals. If this metric climbs a bit more, it could trigger a major shift in favor of the bulls, essentially forcing bears out of the market.

Whales Are Buying, Retail Is Selling

Another interesting trend: Data from Santiment shows that large Bitcoin holders (“whales”) are accumulating more Bitcoin, while smaller holders (“retail”) are selling. This is a classic bullish signal. Whales are buying the dip, suggesting they see a future price increase.

A Temporary Setback?

Despite the positive on-chain data, Bitcoin’s price recently dipped below $103,000. This short-term drop is likely due to the recent US military strikes on Iran, causing a general market risk aversion. Bitcoin’s price reacted similarly to similar geopolitical events in the past.

The Bottom Line

While there’s been a recent price dip, the underlying data suggests a potential bullish reversal for Bitcoin. The combination of strong buyer support, whale accumulation, and the unusual spike in long liquidations without a price crash paints a picture of a market poised for a potential upward swing. However, remember that the market is volatile, and geopolitical events can always impact the price.