China recently pumped a massive $22.4 billion into its economy. This could have big effects on global finance, especially crypto markets which have been going through a rough patch.

China’s Money Moves

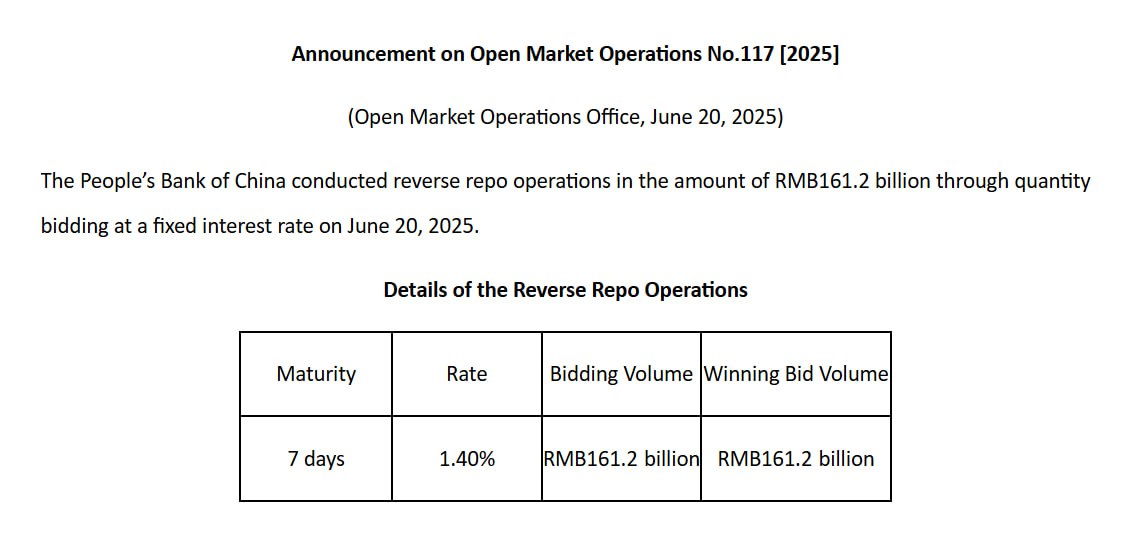

The People’s Bank of China (PBOC) announced this cash injection on June 20th. They used a method called “reverse repos” – basically, they temporarily gave banks extra cash to boost the system’s liquidity. This isn’t a one-off event; it’s part of a broader trend of China easing its monetary policy. Earlier this year, they freed up a whopping $138 billion in long-term liquidity, which coincided with Bitcoin hitting a new all-time high.

While this latest injection is short-term, crypto analyst Ted Pillows points out it shows China’s M2 money supply (a measure of the total money in circulation) is growing again. A rising M2 usually means more money sloshing around, which is generally good news for both traditional and crypto markets. Given the recent crypto downturn, this could signal a bullish comeback.

Will the US Follow Suit?

With China taking action, there’s speculation the US Federal Reserve might do something similar. However, analysts at Wells Fargo predict the Fed will stick to its current plan of reducing the money supply throughout 2025.

Current Crypto Market Status

At the time of writing, the total value of all cryptocurrencies is around $3.14 trillion, down slightly from the previous day. Daily trading volume is also down. Bitcoin, the biggest cryptocurrency, is trading at around $102,784, showing some losses over the past day and week.