May Mayhem in the Market

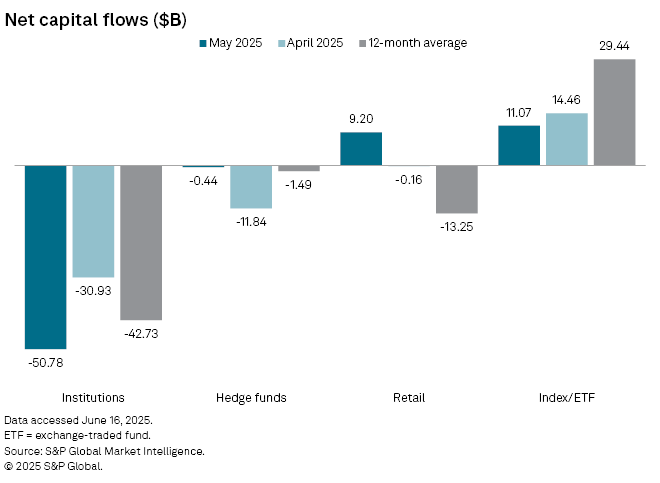

Institutional investors pulled a massive $50.78 billion out of the stock market in May. That’s way up from April’s $30.93 billion and higher than the average monthly sell-off of $42.73 billion over the past year. The main reasons? Concerns about trade wars and Moody’s downgrade of the US credit rating.

S&P Global’s Thomas McNamara explained that the lingering uncertainty around tariffs, a potential recession, and general global instability are keeping investors on edge. They’re not feeling confident yet.

Index Funds Buoy the Market (Slightly)

While institutional investors were selling, index and exchange-traded funds (ETFs) bought a net $11.07 billion in May and $14.46 billion in April. However, even these purchases were below the 12-month average of $29.44 billion.

McNamara points out that stock market activity is rarely a simple “zero-sum game.” He suggests that share buybacks played a significant role in May’s market movements, possibly explaining the market’s rebound despite the lack of strong investor confidence.

Mixed Market Results

The market reacted differently across the board. The S&P 500 saw a slight 0.25% increase last month, and the Nasdaq Composite rose almost 1.6%. However, the Dow Jones Industrial Average dipped by about 1.4%.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before making any investment decisions.

/p>