Bitcoin’s price has been bouncing around lately, but a new analysis suggests a big move is coming. This analysis combines Bitcoin’s price chart with global money supply data, and the results are pretty interesting.

The Money Supply Connection

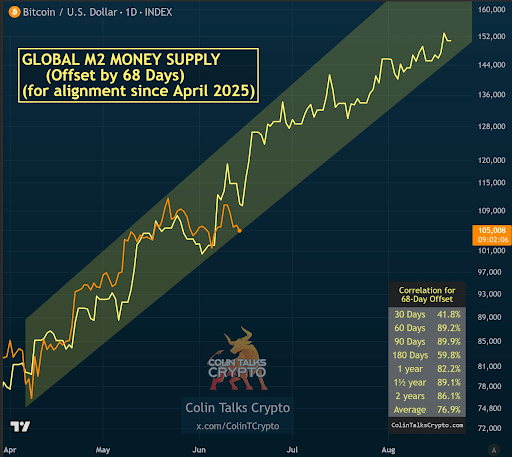

A crypto analyst, known as “The M2 Guy,” found a strong link between Bitcoin’s price and the global M2 money supply (which measures the total amount of money in circulation). When you shift the money supply data by 68 to 76 days, it closely matches Bitcoin’s price movements.

Two charts illustrate this: one showing a 68-day offset, and another showing a 76-day offset. Both show a remarkably similar pattern between Bitcoin’s price and the adjusted money supply. The correlation is very high—around 77%—suggesting a strong relationship.

What This Means for Bitcoin

The analyst’s charts suggest that Bitcoin’s price is lagging behind the growth in the money supply. Since the money supply is still rising, the prediction is that Bitcoin’s price will follow suit.

This means Bitcoin could soon break above $110,000 and potentially even reach new all-time highs. The 68-day offset chart shows impressive accuracy since April, while the 76-day offset shows a strong correlation over longer periods. The accuracy is even more impressive given the recent influence of Spot Bitcoin ETFs on price.

The Prediction: A Quick Rise?

The analyst believes Bitcoin could surge in the coming days. If the trend continues, Bitcoin is projected to move within a rising channel, eventually surpassing $150,000 in August. At the time of this writing, Bitcoin is trading around $106,549. It’s definitely a prediction worth watching!