Big Bitcoin investors, the “mega whales,” are buying less Bitcoin lately. This could be bad news for the price.

What’s the Deal with Mega Whales?

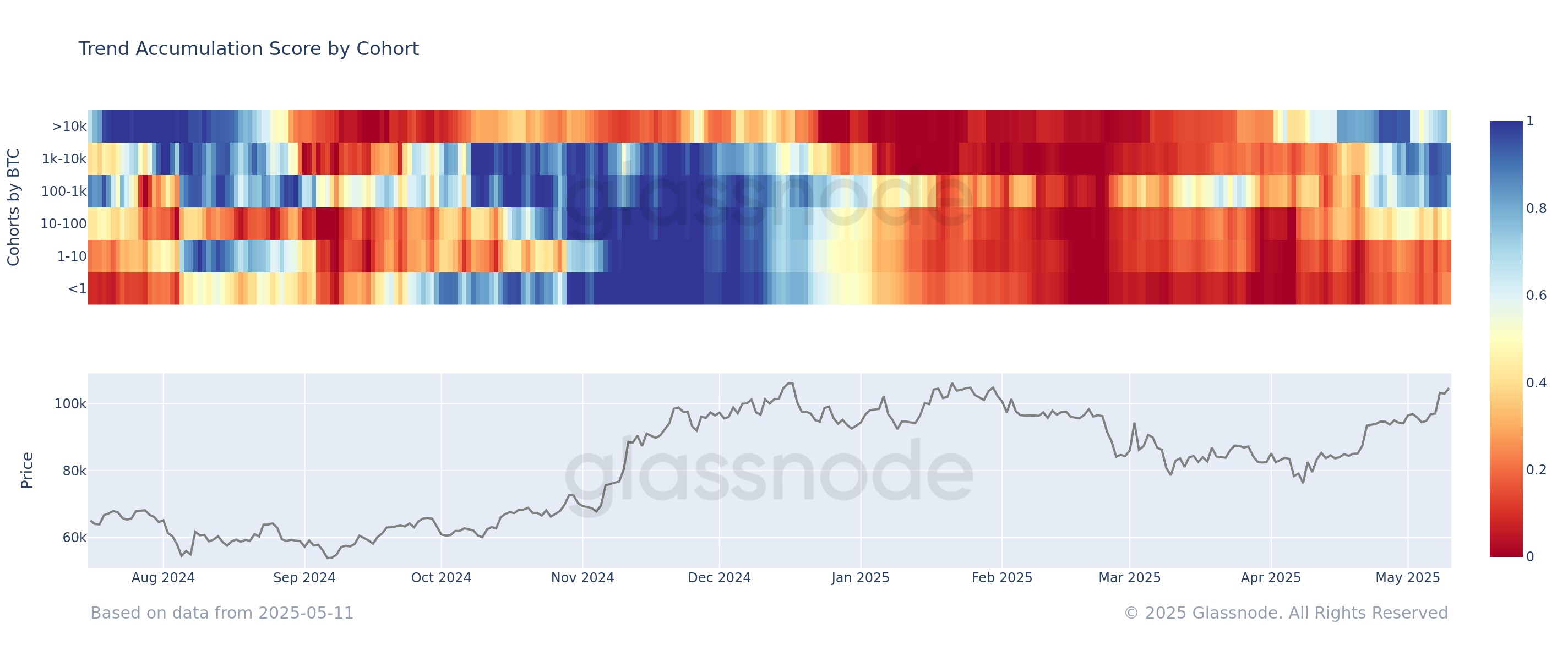

A company called Glassnode tracks how much Bitcoin different groups of investors are buying and selling. They use something called an “Accumulation Trend Score.” This score shows whether investors are mostly buying (accumulating) or selling (distributing). The score weighs bigger investors more heavily – so a few mega whales can really move the needle.

A score above 0.5 means big investors are accumulating. Below 0.5 means they’re distributing. A score of 1 is maximum accumulation, and 0 is maximum distribution.

The Scorecard: Who’s Buying, Who’s Selling?

Here’s the breakdown:

- Small Fry (less than 1 BTC and 1-10 BTC): These guys are mostly selling. Their score is below 0.5.

- Sharks (100-1000 BTC): These are still buying big time. Their score is around 0.8.

- Whales (1000-10,000 BTC): Also still accumulating strongly, with a score around 0.9.

- Mega Whales (10,000+ BTC): This is where things get interesting. Earlier this year, they were buying aggressively, reaching a near-perfect score. But recently, their score has dropped to around 0.5 – neutral. They’ve slowed down their buying significantly.

What Does This Mean for Bitcoin’s Price?

Mega whales slowing down could hurt the current Bitcoin price rally. While sharks and whales are still buying, the mega whales’ shift to a neutral stance is a potential warning sign.

We’ve seen this before. In late 2024, a similar mega-whale selloff preceded a broader market downturn. Their actions often seem to predict market trends.

The Current Bitcoin Price

Bitcoin’s price has stalled recently, hovering around $104,000. Keep an eye on the mega whales’ Accumulation Trend Score – it might give us clues about what’s coming next.