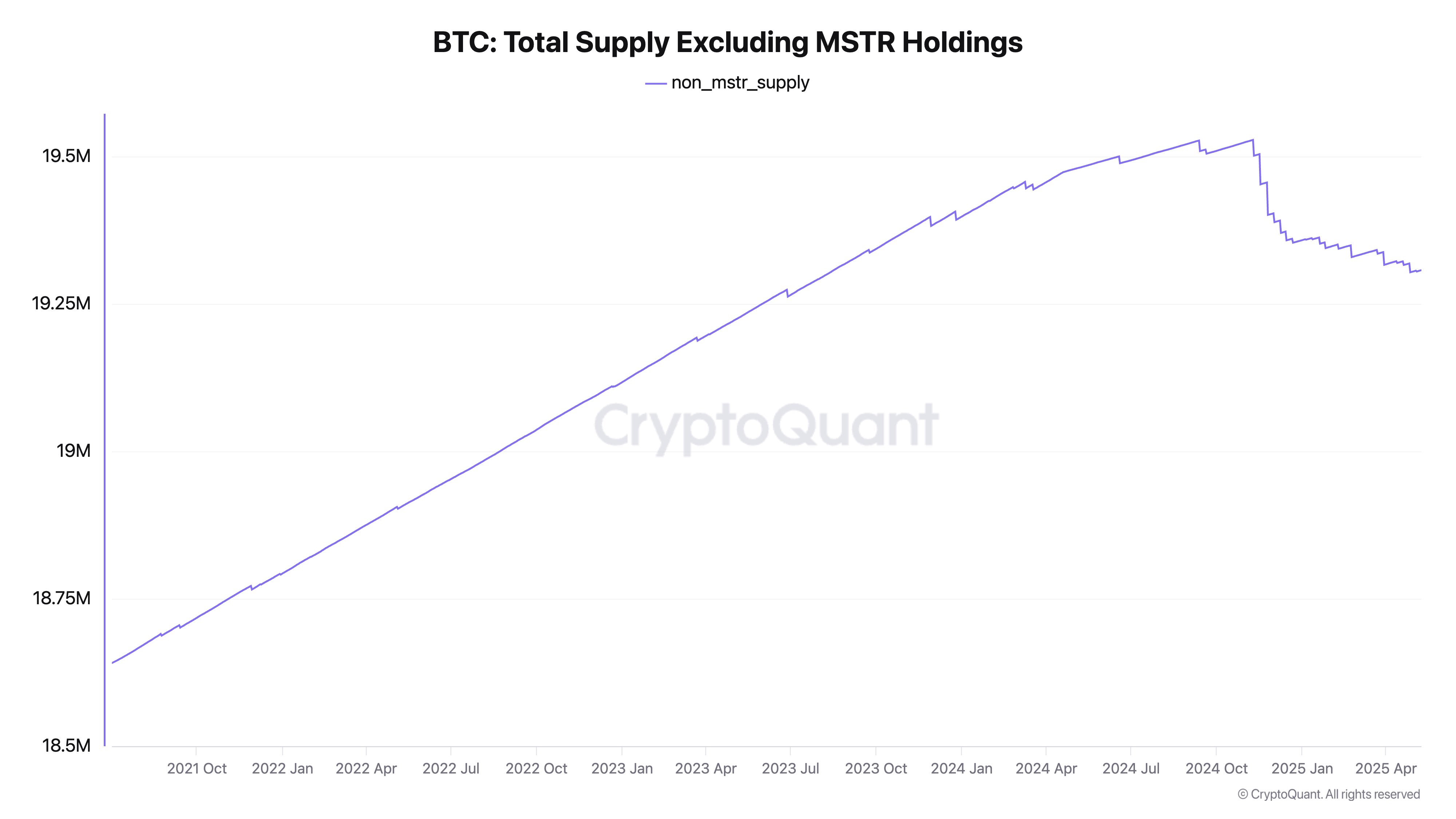

CryptoQuant’s CEO, Ki Young Ju, claims Bitcoin is acting like a deflationary asset. This is because a company called MicroStrategy (MSTR) is buying up Bitcoin faster than miners can create new coins.

MicroStrategy’s Massive Bitcoin Hoard

Ju tweeted that MSTR’s massive Bitcoin holdings—over 555,000 BTC, worth roughly $58 billion—are essentially locking up a significant portion of the available supply. He estimates this alone creates a 2.23% annual deflation rate, and that number could be even higher when you consider other large institutional investors. This is despite the fact that new Bitcoins are constantly being mined.

A Changing Market Landscape

Ju also noted that the Bitcoin market is much more complex than it used to be. It’s no longer just whales, miners, and retail investors driving the price. Now, ETFs, institutional investors, and even governments are involved, making price prediction much harder. He believes that the increased involvement of these players has eased selling pressure.

From Simple to Complex

In the past, Bitcoin price movements were easier to predict. When large holders (“whales”) sold, it triggered a domino effect of selling, leading to price drops. The current market is far more diverse, making it difficult to predict future price movements.

Disclaimer: This information is for general knowledge only and is not financial advice. Always do your own research before investing in cryptocurrencies.

/p>