Bitcoin recently surged past $100,000, exciting investors. But a closer look at the data reveals a potential problem.

A Price Jump, But Low Interest

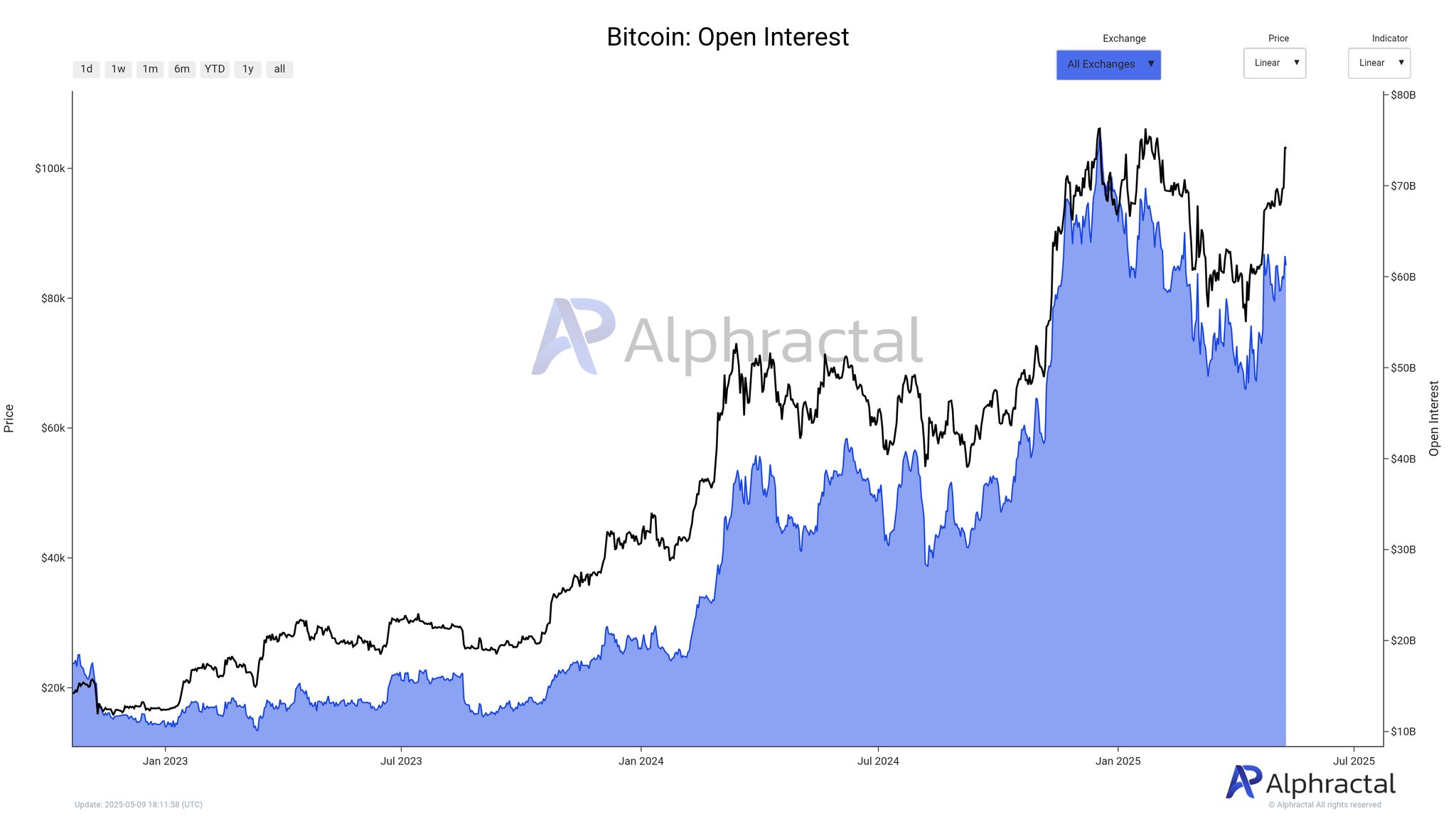

While Bitcoin hit a high of $103,800 (its best since January!), the amount of money invested in Bitcoin derivatives hasn’t followed suit. This is measured by “open interest” (OI), and it’s lower now than the last time Bitcoin was around this price.

What does this mean? A rising OI usually signals bullish sentiment – more people are betting on Bitcoin going up. The current OI is around $61.3 billion, lower than the $68 billion seen previously at similar prices. This suggests less activity and lower leverage in the market.

What’s Behind the Low Interest?

One possibility is recent liquidations (investors losing money and selling) or people closing their positions. Another factor is “Whale Position Sentiment,” which tracks what large investors are doing. Currently, it’s dropping, indicating that big players are closing their long positions (bets that Bitcoin will go up). This shift in sentiment could lead to price stagnation or even a correction (a price drop).

Should You Be Worried?

Bitcoin is currently trading around $103,035. While the recent price jump is positive, the low open interest and changing whale sentiment suggest caution. It’s possible we’ll see a new all-time high, but a price correction is also a real possibility.