Bitcoin’s price recently blasted past $100,000, surprising everyone after months of bearish predictions. CryptoQuant’s CEO, Ki Young Ju, has completely changed his tune, going from bearish to bullish. He says it’s time to ditch the old ways of predicting market cycles.

The Market’s Evolved

Ju explains that the Bitcoin market isn’t driven by the same players as before. Previously, the actions of large “whales” (early investors), miners, and retail investors dictated market trends. Selling pressure from these groups signaled potential cycle tops. But things have changed.

The New Normal: More Liquidity, Less Whale Power

The market’s now much more diverse thanks to things like the approval of Spot Bitcoin ETFs in 2024. This opened the doors for institutional investors with deep pockets to enter the game. This massive influx of liquidity means that even huge sell-offs from whales don’t impact the price as much as they used to.

Time to Retire the Old Cycle Theory?

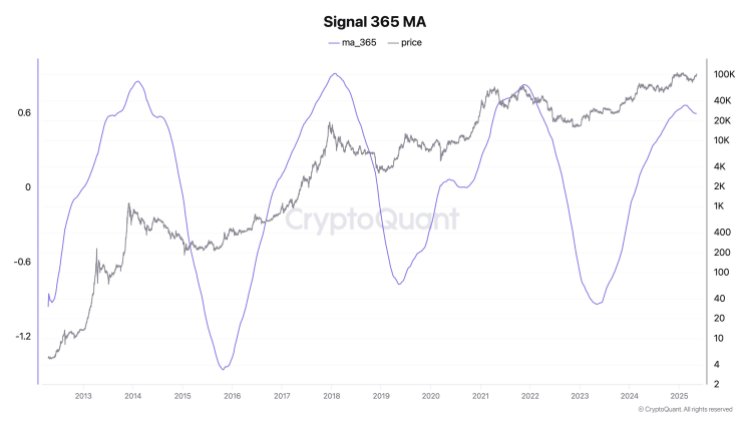

Because of this shift in liquidity, Ju thinks the old cycle theory is outdated. Instead of focusing on whale selling, he says we should be watching how much new money is flowing in from institutions and ETFs. This new money can easily offset even large sell-offs.

A Cautious Optimism

However, Ju isn’t completely jumping for joy. He notes that the market is still adjusting to all this new liquidity, and indicators aren’t giving clear bullish or bearish signals. It’s still a bit of a waiting game.

The Current Situation

Despite the uncertainty, Bitcoin’s price is strong, pushing towards $109,000. IntoTheBlock data shows a staggering 99% of Bitcoin holders are currently in profit. It’s a very bullish picture, but only time will tell what the future holds.