Ethereum’s price has been a bit sluggish lately, but a cool long-term indicator suggests things might be looking up.

A Macro Indicator Hints at a Turnaround

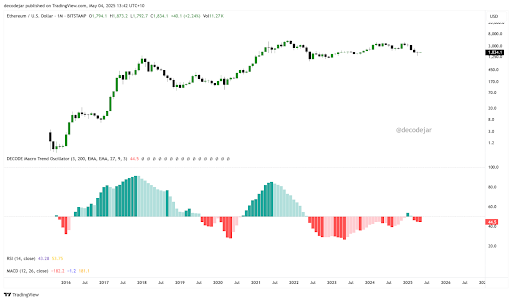

A crypto analyst called Decode created a macro trend oscillator that’s showing signs of recovery after a long bearish period. If this holds, it could mean a significant price increase for Ethereum.

Subtle Shifts Suggesting a Bullish Trend

Decode’s oscillator’s monthly chart (comparing it to Ethereum’s monthly price) shows just how long and deep the recent downturn has been. The red bars representing weakness lasted much longer than usual. While January briefly showed some green, it was a false start.

However, the recent red bars are shorter than those seen in 2023 and 2024. This is clearer on shorter timeframes (like the 3-day chart), which shows a bounce back from the negative zone and a small green bar before a recent pullback. Decode sees this as a potential early sign of a turnaround. Historically, sustained green bars on this oscillator have preceded significant price increases in Ethereum and the broader crypto market.

A Broader Economic Perspective

Decode’s oscillator doesn’t just look at crypto; it also tracks the S&P 500 and other major economic trends. The pattern is consistent: green periods are longer and stronger than red ones. This reflects the tendency of assets to grow rather than shrink. It’s not just a simple indicator; it’s a complex index using 17 different metrics, including stocks, bonds, commodities, currency, central bank liquidity, and even sentiment.

Ethereum’s Potential Uptrend

For Ethereum, this gradual shift towards green suggests a possible price surge. Although Ethereum recently dipped to $1400, the improvement in Decode’s oscillator hints at a new uptrend. The key is seeing consistent green bars across different timeframes.

Current Market Conditions

At the time of writing, Ethereum is trading around $1830. A recent dip below $1800 triggered liquidations of roughly $35.92 million in ETH, with longs accounting for $28.38 million.