Tether’s CEO, Paolo Ardoino, issued a stark warning: he believes many European banks are on the brink of collapse in the next few years. He blames new EU regulations on stablecoins.

A Recipe for Disaster?

Ardoino argues that the EU’s stablecoin regulations are creating a dangerous situation. These rules require stablecoin issuers to hold a significant portion of their reserves (60%) in uninsured cash deposits within European banks. He uses a hypothetical example to illustrate the problem:

A stablecoin with €10 billion market cap would need to keep €6 billion in uninsured deposits. Because banks operate on fractional reserves (loaning out a large portion of deposits), only a small fraction of that €6 billion would actually be readily available. If even a small percentage of stablecoin holders wanted to cash out (say, 20%, or €2 billion), the bank wouldn’t have enough funds to cover it, leading to both the bank and the stablecoin issuer failing.

Smaller Banks, Bigger Risk

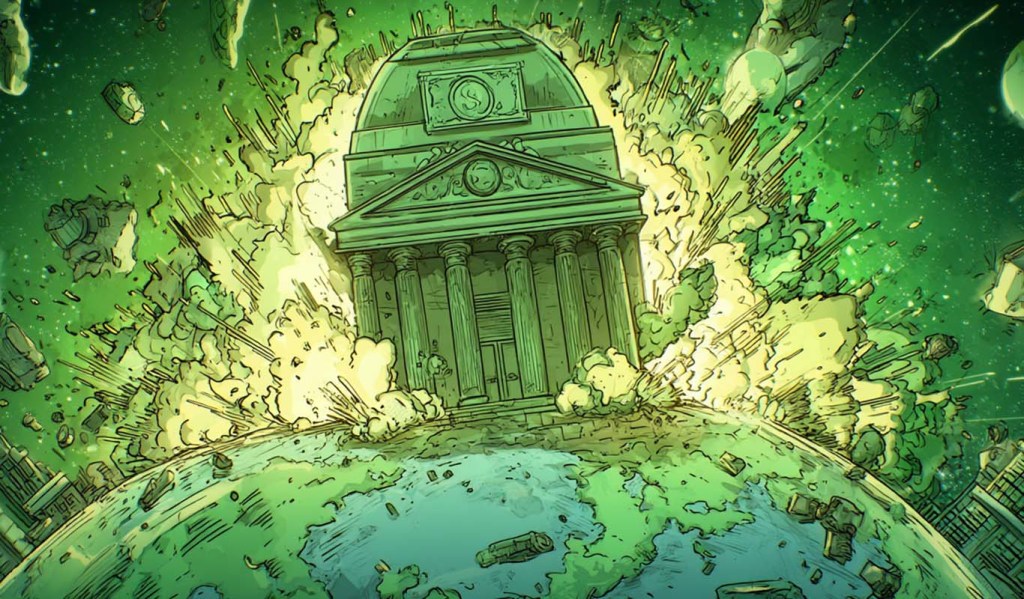

Ardoino points out that major financial institutions are hesitant to work with stablecoins. This forces stablecoin companies to rely on smaller, riskier banks to comply with the regulations. He sees this as a direct path to a widespread banking crisis, similar to the Silicon Valley Bank collapse. He predicts that many European banks will face similar issues and ultimately fail.

The Bottom Line

Ardoino’s prediction is a serious one, highlighting concerns about the potential unintended consequences of new financial regulations. He believes the current system is inherently unstable and likely to trigger a banking crisis in Europe.