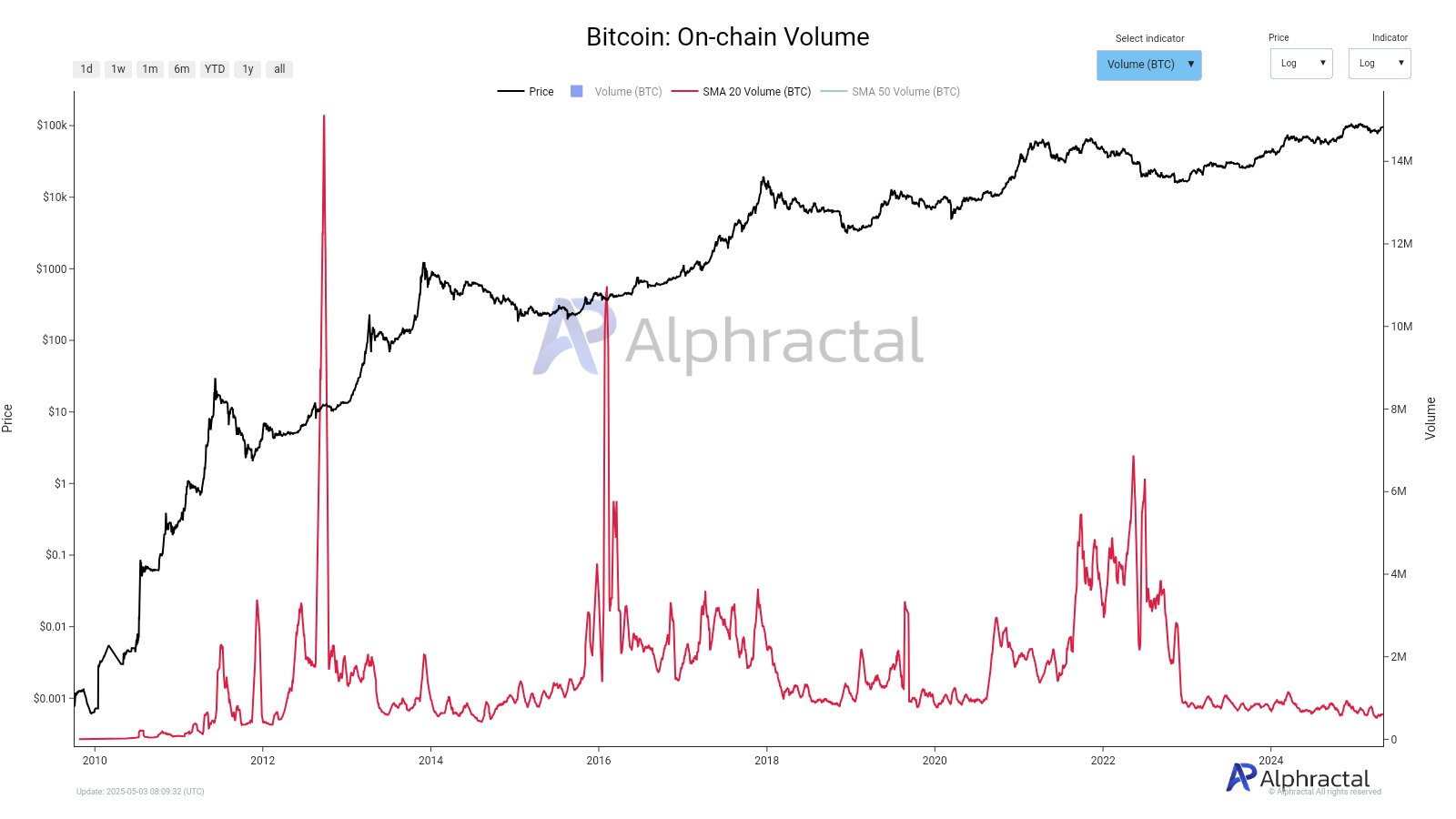

Bitcoin’s price is usually a good reflection of how busy its blockchain is. High activity usually means a higher price. But lately, that’s not been the case. Bitcoin’s price is staying above $95,000 even though blockchain activity is low. Why?

Why Bitcoin’s Price Isn’t Following Blockchain Activity

An analytics firm, Alphractal, offers some explanations:

-

The ETF Effect: The approval of Bitcoin ETFs in January 2024 changed the game. Now, money flowing into Bitcoin through these ETFs is more important than blockchain activity itself.

-

Low Volatility: Because the price hasn’t been changing much, traders aren’t as eager to buy or sell, leading to less activity on the blockchain.

-

Speculative Trading: A lot of Bitcoin’s price action is driven by traders using derivatives and other financial tools, not everyday users. This means less actual use of the Bitcoin network.

-

Macroeconomic Uncertainty: The global economy is still a bit shaky, making investors hesitant to jump in until they see clearer signs of growth.

-

Inflated Exchange Volume: Some reported trading volume might be fake, making the activity seem higher than it actually is.

Bitcoin’s Current Price

At the moment, Bitcoin is trading around $96,150, down slightly over the last 24 hours but still up for the week.