Bitcoin is booming, and its exchange-traded funds (ETFs) are feeling the heat! Investors are piling into Bitcoin ETFs, showing major confidence in the cryptocurrency’s recent price surge.

Record Inflows for Bitcoin ETFs

Last week alone, US Bitcoin Spot ETFs saw a massive $1.81 billion in net inflows. This is the third-largest weekly inflow of 2025, highlighting the growing institutional interest in Bitcoin. The overall market is up, with Bitcoin’s price jumping from around $84,000 to $97,000 in just two weeks. This surge is clearly driving investment into ETFs.

BlackRock Dominates

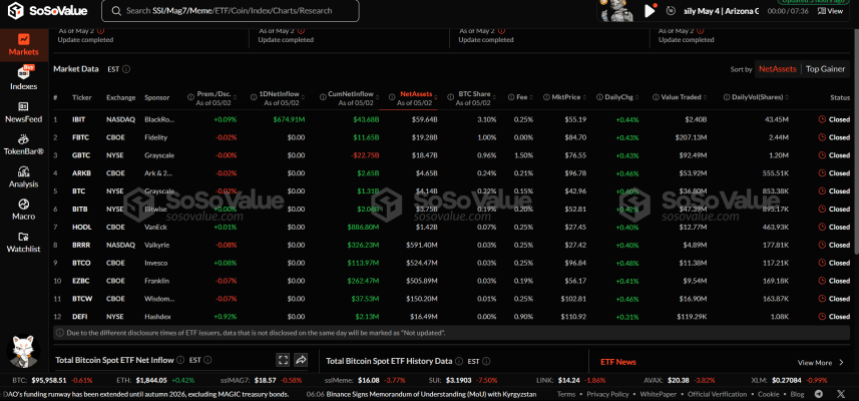

BlackRock’s IBIT ETF was the star performer, attracting over $2.48 billion in net inflows – including a whopping $674.91 million on May 2nd alone! Other ETFs like Grayscale’s BTC, VanEck’s HODL, and Invesco’s BTCO also saw positive inflows, though on a smaller scale ($10 million – $41 million). However, not all ETFs fared well. Fidelity’s BTCO saw a significant outflow of $201.90 million, and Grayscale’s GBTC and Bitwise’s BITB also experienced withdrawals. Some ETFs, like Franklin Templeton’s EZBC, showed no movement at all.

Overall ETF Performance

After this strong week, US Bitcoin Spot ETFs now boast a total net inflow of $40.24 billion, with total net assets reaching $113.15 billion – a significant 5.87% of Bitcoin’s total market cap.

Ethereum ETFs Also See Growth

It’s not just Bitcoin; Ethereum ETFs are also experiencing a mini-boom. They saw over $250 million in net inflows over the past two weeks, with $106.75 million coming in last week alone. BlackRock’s ETHA ETF led the charge. Currently, Ethereum ETFs have a total net inflow of $2.51 billion and total net assets of $6.40 billion (2.87% of Ethereum’s market cap).

Current Market Prices (at time of writing):

- Bitcoin: $95,514

- Ethereum: $1,845 (down 0.49% in the last 24 hours)