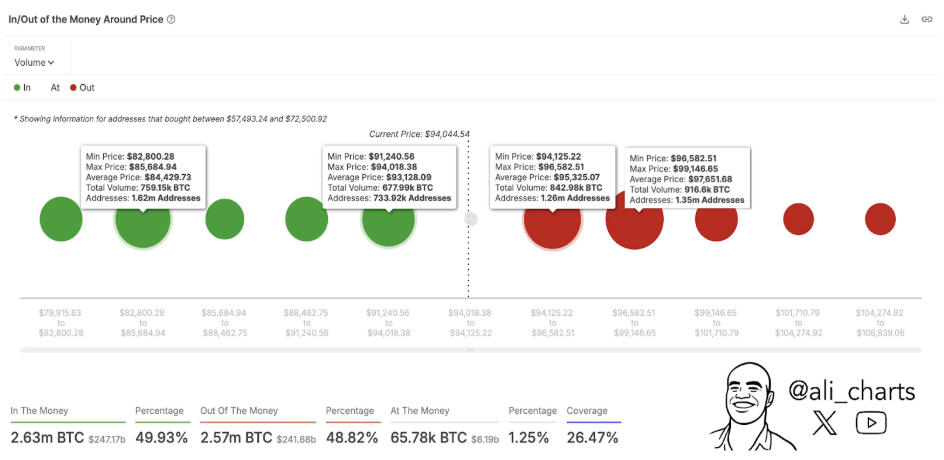

Bitcoin is facing a crucial test right now. It’s hitting a major resistance zone between $94,125 and $99,150, and whether it can break through will determine its short-term direction.

A Wall of Bitcoin

According to crypto analyst Ali Martinez, a huge number of Bitcoin holders – around 1.76 million BTC – are clustered in this price range. This creates a massive hurdle for Bitcoin to overcome. The concentration is so high that it’s one of the biggest obstacles Bitcoin has faced recently. Breaking through this resistance decisively, especially with a strong daily or weekly close above $96,600, would likely push Bitcoin towards $99,150 and potentially $100,000. Failure to break through, however, could send the price back down to test support levels around $93,000 and $84,000.

The Bigger Picture: Still Bullish?

Despite the immediate challenge, many analysts remain optimistic about Bitcoin’s long-term prospects. Titan of Crypto, for example, still sees a potential price target of around $125,000. This prediction is based on a powerful technical pattern called an “Inverse Head and Shoulders” on the monthly chart. The breakout from this pattern earlier this year, coupled with the current price action holding above key support, suggests a strong possibility of a new all-time high. However, maintaining support around $85,000 to $87,000 remains crucial for this bullish scenario to play out.

At the time of writing, Bitcoin is trading around $94,147. The next few weeks will be critical in determining whether Bitcoin can conquer this resistance and continue its upward trajectory.