Bitcoin’s price has historically followed a predictable pattern: upswings, sideways movement, and downswings. But lately, things are getting interesting. Experts are questioning whether Bitcoin is about to break free from its usual cycle.

Is This Cycle Different?

Ki Young Ju, founder of CryptoQuant, initially predicted the bull cycle would end in March 2025. He’s now reconsidering, suggesting Bitcoin might be defying its typical pattern. Another analyst, Darkfost, on X (formerly Twitter), agrees that this cycle could be unique.

A Hostile Market for Risk

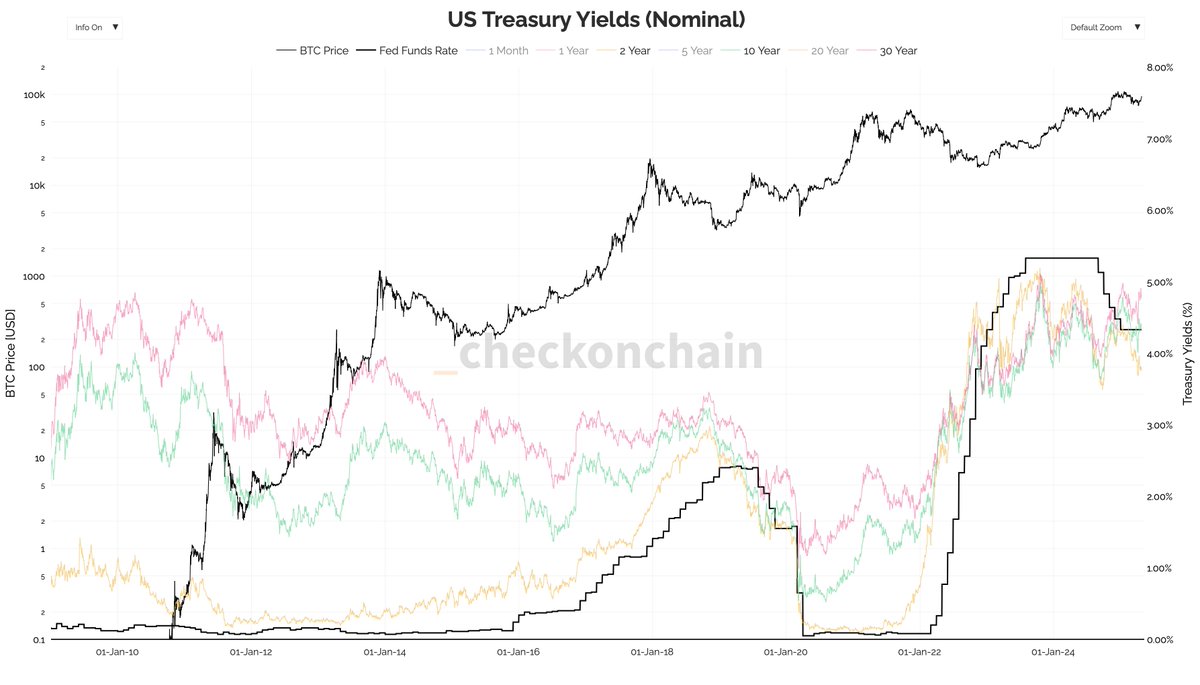

Darkfost argues that Bitcoin has never faced such challenging market conditions. High interest rates make safer investments, like Treasury bonds, very attractive. Why would big investors risk their money on Bitcoin when they can get a safe 5% return elsewhere? The fact that short-term Treasury yields are higher than long-term yields is also unusual and historically significant.

Despite this, Bitcoin has still managed to hit new all-time highs. This suggests that the usual flow of money into riskier assets isn’t happening as expected. Yet, Bitcoin is still performing well.

Uncertainty and the Future

Darkfost points out that the potential re-election of Donald Trump adds another layer of uncertainty. While Bitcoin’s current cycle still looks somewhat typical, Darkfost believes that if macroeconomic conditions improve between now and 2026, we could see the first truly unique Bitcoin cycle in history.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $94,752, down about 0.5% in the last 24 hours.