Bitcoin’s price has skyrocketed past $90,000 and is now trading above $95,000! Let’s dive into what’s fueling this incredible rally.

Who’s Behind the Bitcoin Boom?

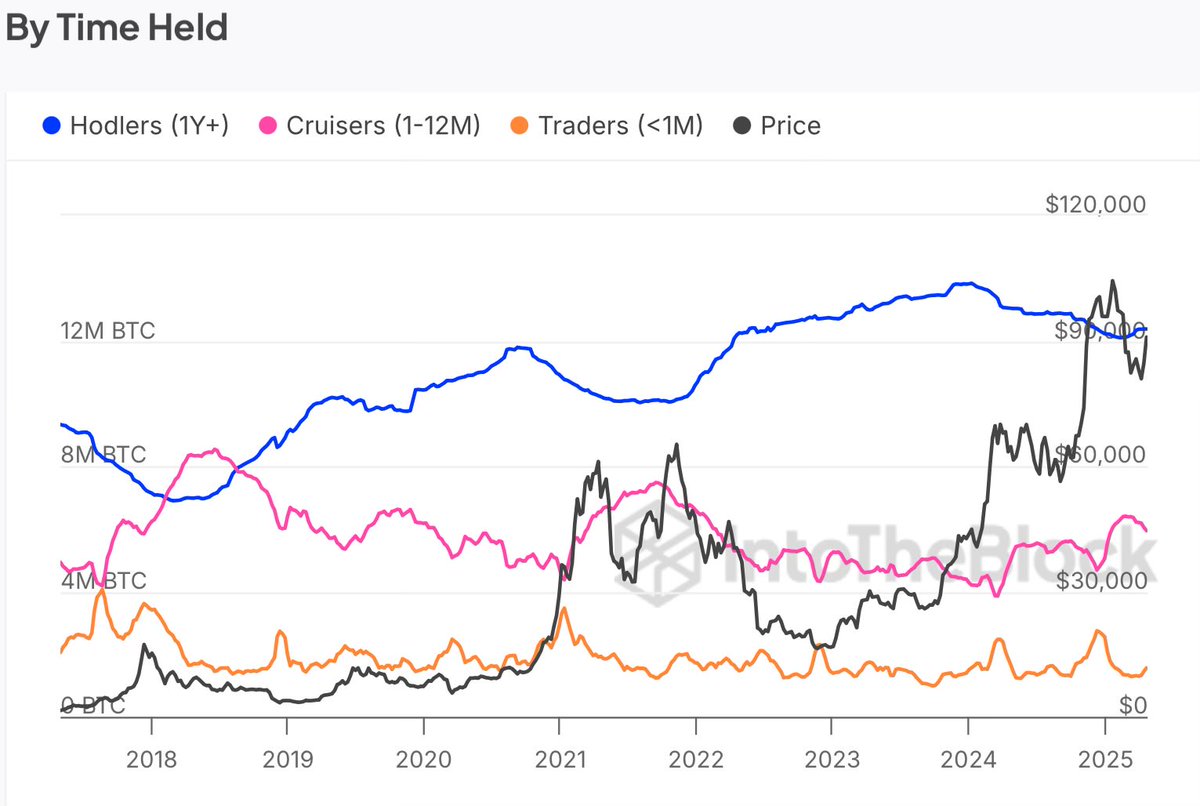

A cryptocurrency analyst, IT Tech, recently analyzed the Bitcoin price surge from around $74,000 to its current level. Their findings point to a fascinating shift in investor behavior.

The Role of Different Investor Groups

The analysis focuses on different types of Bitcoin investors based on how long they’ve held their coins:

-

Short-Term Holders (Traders): These investors are highly reactive and driven by fear of missing out (FOMO). They’ve been aggressively buying Bitcoin, boosting their holdings by almost 19% in the last month. Their activity is a major factor in the recent price increase.

-

Long-Term Holders: Interestingly, long-term holders haven’t been selling off their Bitcoin recently. This lack of selling pressure has helped support the price. Their holdings have actually increased slightly (by at least 0.3%) over the past month.

-

“Cruisers” (1-12 Month Holders): This group has seen a 4.4% decrease in holdings. The analyst suggests they might be either becoming long-term holders (“Hodlers”) or taking profits.

A Speculative Bull Market?

IT Tech believes Bitcoin might be entering a speculative bull market, driven by significant short-term investment and supported by long-term stability. However, there’s a cautionary note.

The Volatility Factor

The analyst highlights the risk associated with the dominance of short-term holders. Historically, their influence correlates with high price volatility. This means we could see some wild swings in the Bitcoin price in the future.

The Bottom Line

Despite the potential for volatility, IT Tech believes Bitcoin hasn’t reached its peak yet. As of now, Bitcoin is trading around $95,210, up 2% in the last 24 hours.