Chainlink (LINK) has shown a month of consistent coin withdrawals from exchanges, which could be great news for the price.

Money Moving Out of Exchanges

IntoTheBlock, a market analysis company, noticed a trend: a lot of LINK is leaving centralized exchanges. “Exchange Netflow” tracks how much LINK is moving into and out of exchange wallets. Positive netflow means more LINK is going into exchanges (often to be sold), which is usually bad for the price. Negative netflow means more LINK is leaving exchanges, suggesting people are holding onto it for the long term – a potentially bullish sign.

The Chart Speaks

Over the past month, Chainlink’s Exchange Netflow has been strongly negative. This means about $120 million worth of LINK has left exchanges. This suggests investors are accumulating LINK, anticipating price increases. LINK’s price has recently bounced back a bit, possibly because of this buying activity.

What to Watch For

The Exchange Netflow is key to watch. If the outflow continues, it’s a good sign for Chainlink. But if it reverses and becomes positive, the price recovery could end.

Potential Price Resistance

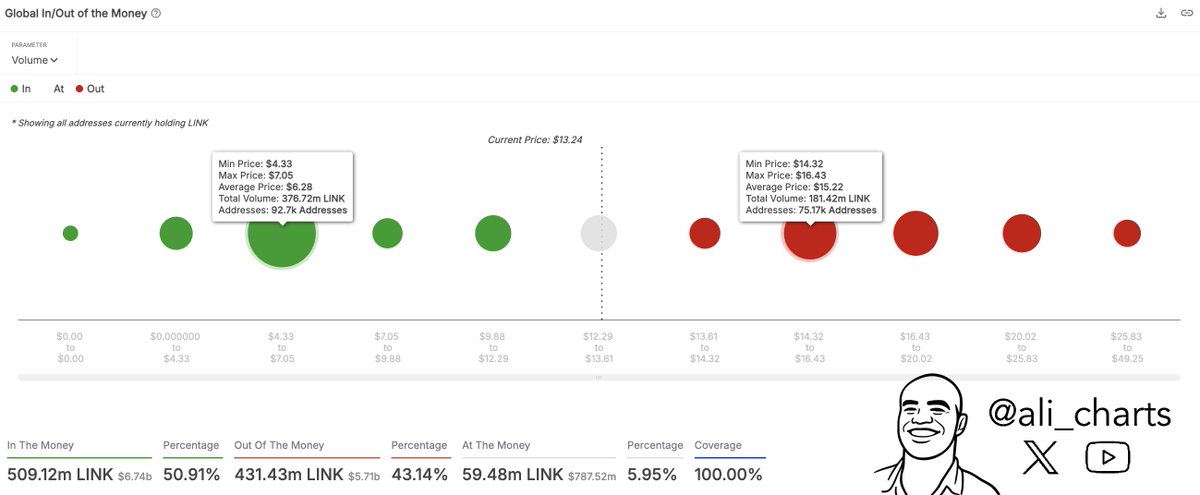

Analyst Ali Martinez points out that a large number of LINK holders bought between $14.32 and $16.43. If the price rises again and tests this range, these investors might sell to break even, creating resistance.

Current Price

At the time of writing, Chainlink is trading around $13.74, up over 10% in the last week.