Bloomberg analyst Mike McGlone is predicting a significant market correction that could severely impact Bitcoin, oil, and stocks. He believes the US has a built-in “self-correcting mechanism” that might react against recent economic policies, leading to market turmoil.

A Looming Market Correction?

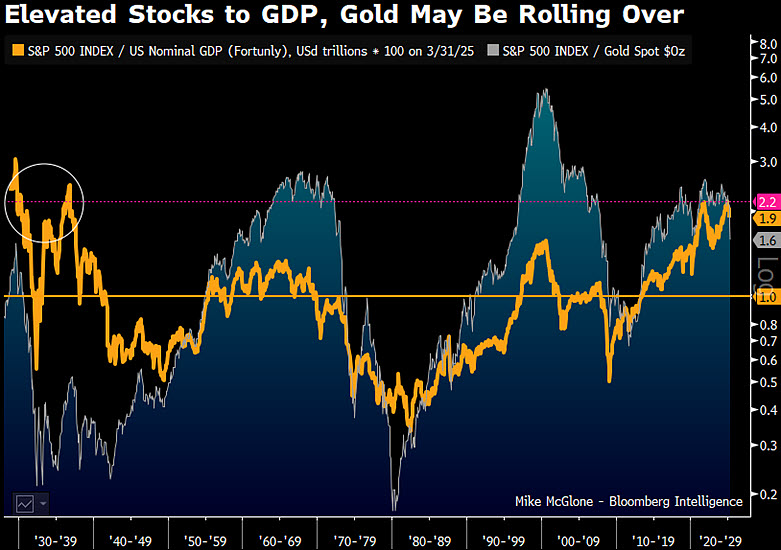

McGlone points to historical data showing that the ratio of the S&P 500 to GDP and the S&P 500 to gold are currently very high. This pattern has historically preceded major market crashes, like those in the 1930s, late 1990s, and 2008. He suggests this “reversion” could cause substantial drops across various assets.

McGlone’s Predictions

McGlone’s forecast includes some drastic drops:

- Stocks: A 50% drop in the US stock market.

- Oil: Crude oil falling to $40 a barrel.

- Copper: Copper dropping to $3 per pound.

- Bitcoin: Bitcoin falling to $10,000 (a significant drop from current prices). Most other cryptocurrencies could see a 90% decline.

- Gold: Gold is predicted to fall to $4,000, though McGlone notes this is an outlier due to its unique market dynamics.

- US 10-Year Yield: A 3% yield.

“Normal” by Historical Standards

While these predictions seem extreme, McGlone emphasizes that the magnitude of these potential drops is “normal” based on historical market corrections. He highlights that the current market valuations are unusually high compared to historical norms.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before making any investment decisions./p>